The change in China's energy matrix and its relationship with Latin America

- blog de anegrete

- 3391 lecturas

In OBELA we have mentioned that the US does not have the technological capacity for an accelerated change of its energy matrtheix in general, nor in the automotive field in particular. 1 For its part, China is shifting its energy matrix into clean energy generation of electricity, such as solar, wind, hydroelectric, cellulose and even nuclear sources. The energy transition is a process of structural change of energy supplies. Currently, it focuses on generating green energy. With global attempts to make economies greener, i.e. not emitting CO2, it seems that China leads in three fields: nuclear, solar and hydroelectric.

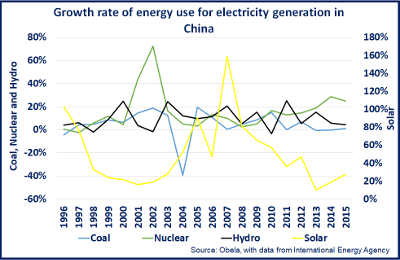

Electricity generation in the Asian country is still given mainly by coal. The important thing is the speed of growth in the use of sources for electricity generation. The use of coal grew at 9% p.a. between 1995 to 2004, then came a regulatory change mandating to generate less coal energy and the speed of growth was reduced to 6% between 2006 and 2013. From 2014 onwards, the average growth rate is 0%. Nuclear energy has an average growth trend of 15% p.a. since 1995 relatively steady. Solar energy has average annual rates of 42% p.a. from 1995 to 2004, and from 2006 onwards itu has increased to an average of 55% p.a.. Hydroelectricity has growth rates of 8% p.a. between 1995 and 2004, up to 11% between 2006 and 2016, last date available.

There were 38 nuclear power plants in operation in China in 2017 while 19 more are under construction2. At the same time, it produces its own nuclear reactors and has become the seventh largest exporter of these in the world, after sold mainly to Pakistan. However, China's Latin American trade in nuclear reactors is nil. They generally compete with Russia, Sweeden, the US, Germany, and France and South Corea.

China is also betting on the creation of solar parks, i.e. large plots of land with solar panels for photo voltaic electricity generation. The concept of the ‘solar park’ was first developed in India and China. It has installed solar parks the size of Macao, i.e. 28.2 km².3 To achieve this, it has become the world's largest importer of silicon from the Koreas and Kazakhstan. In addition, since 2008, it is the leading exporter of solar panels with exports four times greater than the U.S., thus leading the global supply of solar panels. This explains the start of the trade war with tariffs on solar panels. A small solar panel of Chinese origin of 295 watts is approximately 42 U.S. dollars cheaper than an American one. India is following its footsteps very quickly.

In Latin America there is one huge solar park in the province of Jujuy in Argentina that contains 1.2 million Chinese solar panels that the Jujuy State government financed with green bonds. The Export-Import Bank of China bought 85% of these issued for the megaproject. It is the largest solar park in Latin America and covers a territory of 800 hectares and produces 2500 kilowatts per square meter and has a total cost of $390 million. The energy will be used for nearby industrial plants, provincial homes and the exploitation of lithium mines that are on the border between Argentina and Bolivia.4 In contrast, in Chihuahua, Mexico the IDB financed a very small $17.2 million solar park with Spanish technology that produces only 80 megawatts in total.

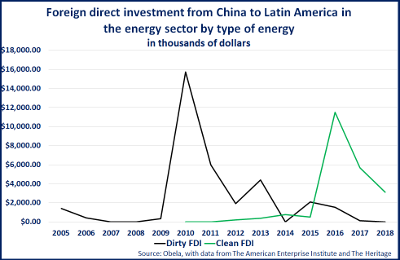

Another green energy source that China promotes is hydropower. As for Latin America, investment in Brazil's hydroelectric sector has been seen through direct foreign investment. Prior to 2015, Chinese foreign direct investment (FDI) in Latin America in the energy sector was centred in the production of oil and natural gas. Henceforth, FDI shifted to clean energy, specifically to the hydropower sector. The purchase of firms in hydropower generation and distribution. State Grid Corporation, a Chinese electricity distributor, bought 55% of CPFL in Brazil; and Three Gorges acquired the properties of DUKE Energy in Brazil, a U.S. hydroelectric company.5 In Peru, Yangtze Power International bought 86.3% of Sempra Energy, the U.S. company that operated through Luz del Sur. 6

In general, China is in the process of changing its energy matrix. There is almost no presence of oil for the new thermoelectric plants, unlike Mexico or the Caribbean Basin. The expansion of trade in solar panels; and investments in the hydroelectric and electricity distribution sectors, give the signal that it is interested in Latin America as a space to dispute energy trade with the U.S. and displace gasoline and oil. This added to the electric car trade completes the picture. Since 2015, China has ventured into the mass transit electric bus market in the cities of Santiago, Medellín, Cali, Guayaquil; and is testing in San José, Sao Paulo, Buenos Aires and Montevideo.7

1 http://www.obela.org/en-analisis/the-heart-of-trade-warfare-the%20technological-race-and-transition

2 https://www.iaea.org/newscenter/news/how-china-has-become-the-worlds-fastest-expanding-nuclear-power-producer

3 https://www.scmp.com/news/china/society/article/2073747/powerful-images-worlds-largest-solar-energy-farms-are-china

4 https://latamlist.com/2019/03/23/china-is-building-latin-americas-largest-solar-plant-in-argentina/

5 https://news.duke-energy.com/releases/duke-energy-to-sell-its-brazilian-business-to-china-three-gorges-corporation-for-1-2-billion-enterprise-value

6 https://lexlatin.com/noticias/yangtze-power-compra-la-mayor-distribuidora-de-energia-de-peru

7 https://dialogochino.net/21995-latin-american-cities-finally-embrace-chinese-electric-buses/