HYPERINFLATION IN ARGENTINA AND VENEZUELA

- blog de bacosta

- 1189 lecturas

Hyperinflation is a phenomenon where prices rise rapidly by more than 50% per month, at the same time as the currency loses its real value and the population has an evident reduction in its monetary wealth. In this text, we would like to argue that there are non-monetary elements1,2 that contribute to this phenomenon

ARGENTINA

The country of tango and football (the most recent world champions) has suffered numerous inflationary cycles throughout its history, four hyperinflations and only a few short periods of price stability. In statistical terms over the last 210 years, they have a regularly high inflation rate, with a historical maximum of 3,079.5% in 1989 and an estimated interannual projection for the year 2023 of 150%.

The following figure shows the behaviour of inflation from 1910 to 2020.

Source: National Institute of Statistics and Census of Argentina. BCSF

Argentina is in the midst of an electoral process and one of the most important issues for the main candidates is to solve the issue of hyperinflation. The libertarian candidate Javier Milei, winner of the primary elections held on 14 August 2023, told the newspaper "El País" that he would put an end to inflation, which has historically devastated Argentina, and proposed eliminating the central bank so that the country would not be able to issue currency. Likewise, recalling the Peruvian Pedro Beltrán, he said that the elimination of the currency issuing machine would put an end to inflation, because it is always a monetary phenomenon. The next step is to dollarise the economy, a radical version of the peso convertibility that in the 1990s reduced inflation to single digits. "From 1993 onwards, Argentina was the country with the lowest inflation in the world. It was the most successful programme in Argentine history," Milei told the newspaper. The candidate does not remember the 2001 crisis where it ended.

During its history, Argentina has implemented a series of measures to control it. In the early 1990s, the then economy minister Domingo Cavallo introduced the convertibility law, which established a fixed parity of the Argentine peso to the US dollar, contrary to what the Austrian neoliberal theorist Ludwen Einrich von Mises proposed. There was also a monetary reform that removed 4 zeros from the peso and thus one Argentine peso became worth the same as one dollar. This period was popularly known as the "one to one". This measure is known as a rigid anchor because the dollar became the unit of reference. They did not liberalise the exchange market, when inflation went down to one digit and the IMF endorsed this with a large loan. The end was an economic, political and social collapse in 2001. The floating of the exchange rate at the beginning of 2002 led to a sincere devaluation of the currency and a skyrocketing poverty rate, which affected two out of three Argentines.

The next government will have to deal not only with the monetary aspect but also with aspects of rising prices due to climatic effects that have been affecting it.

VENEZUELA

The country of the joropo and oil has been observing a rise in prices since 2015, when it began to register rates above 100 %, as a result of retaliation by the United States. In 2017, inflation rose to 2.616 % per year, in 2018 it reached 65.374 % and after some anti-inflationary measures it was reduced in 2019 to 19.906 %. It is the biggest hyperinflation ever suffered by an American country, similar to that of Germany in 1923.

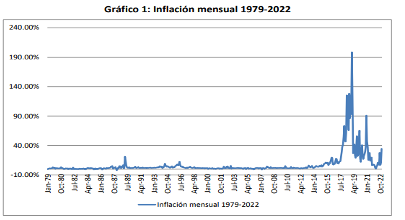

In the following table we can observe the inflation behaviour in Venezuela from 1979 to 2022.

Source: UCAB-Banco Central de Venezuela

In the table we can see that in recent years from 2017 onwards there has been a variation in prices, with attempts to control it as in 2019.

What triggered this situation in the Venezuelan economy?

The causes of inflation are the fall in the price of oil at a certain point in time, sanctions imposed by the US, Canada and the European Union, an unfunded fiscal deficit, among others that have negatively impacted Venezuela's economy.

The most important consequences that can be pointed out are: Mistrust in the national currency and increase of transactions in foreign currency; the loss of the value of the currency (Bolivar) and the subsequent dollarisation of the economy; which in a spiral leads to the readjustment of wages, slowdown of the economy, increase of unemployment, uncertainty and massive emigration sets in.

To overcome this crisis, the government has been developing a series of measures, among which we can point out: reduction of state spending, restrictions on bank credit, elimination of the gasoline subsidy, opening of the foreign exchange market, among others. The result is that as of August 2023, a year-on-year rate of 423% is reported.

As long as the US continues with economic retaliation, emigration can hardly be stopped and inflation control will not be successful.

Both countries facing this situation are forced to take monetary measures, but the non-monetary aspects will be difficult to control. Some countries that have gone through this circumstance can show how painful it is to take these measures through a serious and responsible programme. As the Peruvian finance minister Gustavo Miller said at the time: "God help them".