Amid the growing tensions of the trade war that began in 2018 between the United States and China, US companies began to look to the horizon in search of safer and more stable lands for their products. Against this backdrop of uncertainty and challenges, Japan emerged as a beacon of opportunity, and the concept of friendshoring, distinct from nearshoring, was coined.

The US-China relationship has deteriorated rapidly. Tariffs and trade retaliation have created an atmosphere of uncertainty that unsettles global markets, and political conflicts have created a scenario of possible military conflict. In this tumultuous environment, companies such as Apple, Google, and recently Microsoft (which, along with Facebook, Amazon and Netflix, constitutes the FAANG group) and large investment funds such as Goldman Sachs started to look for alternatives. Japan, with its stable economy and highly skilled workforce, emerged as a natural choice, offering a reassuring beacon of opportunity.

Large US technology corporations gave the first signs of the new direction. Companies in Silicon Valley, the Western heartland of technological innovation, began to look to the rising sun. Technology giants (FAANG) are setting up research and development centres in Tokyo and other Japanese cities. Apple, since 2015, already has a research centre located in Tokyo; Google started operations in Chiba in March 2023, while Microsoft plans to open one sometime in 2024. These centres seek to take advantage of Japan's advanced technological infrastructure and collaborate with local companies on cutting-edge projects.

The Bank of Japan's low-interest rate policy is focused on stimulating the economy and has created an attractive environment for investment. The Japanese government, aware of the opportunity presented, implemented reforms to facilitate the entry of foreign capital, lowered tariff barriers and paved the way for foreign investors.

On Wall Street, fund and private equity managers began redirecting resources to the Japanese market. Tokyo stock markets saw a surge in activity, with the Nikkei 225 index rising steadily from 23,300 points in 2020 to 30,000 points in 2024, an increase of approximately 30%.

The reorientation of capital has significant geopolitical implications, particularly in strengthening the US-Japan alliance in economic and strategic terms. The two nations, already allies in the QUAD, a military agreement to counterbalance Russia and China in the Sea of Japan and the Taiwan Strait, are now further aligning to contain China's growing economic and commercial influence in the region.

Amidst the trade war, Japan has emerged as a safe haven for US companies, offering a narrative of adaptation, opportunity, and collaboration with each new investment and establishment. As tensions persist between the US and China, the Japanese dawn shines brighter, promising a prosperous future for US companies that have found a new home.

These new economic ties affect the traditional security approach and expand technological cooperation, leaving aside competition and existing agreements such as the Security Alliance, signed in 1951. The changes are to have a plan of action in case of a possible military confrontation and create technology research and development centres located in Japan to diversify its dominance in different areas of conflict. Recognising that US strategy often distorts threat perceptions to justify its foreign policy and military objectives is crucial. By presenting China as a significant threat to the American way of life, the US can advance its geopolitical and economic interests in the region with the support of Japan.

The West's technology investment focuses on semiconductors and artificial intelligence. President Biden aims to replace China's goods supply one by one. Given that any Japanese export is highly competitive, which is extremely profitable for the FAANGs, this strategy could resuscitate the Japanese economy.

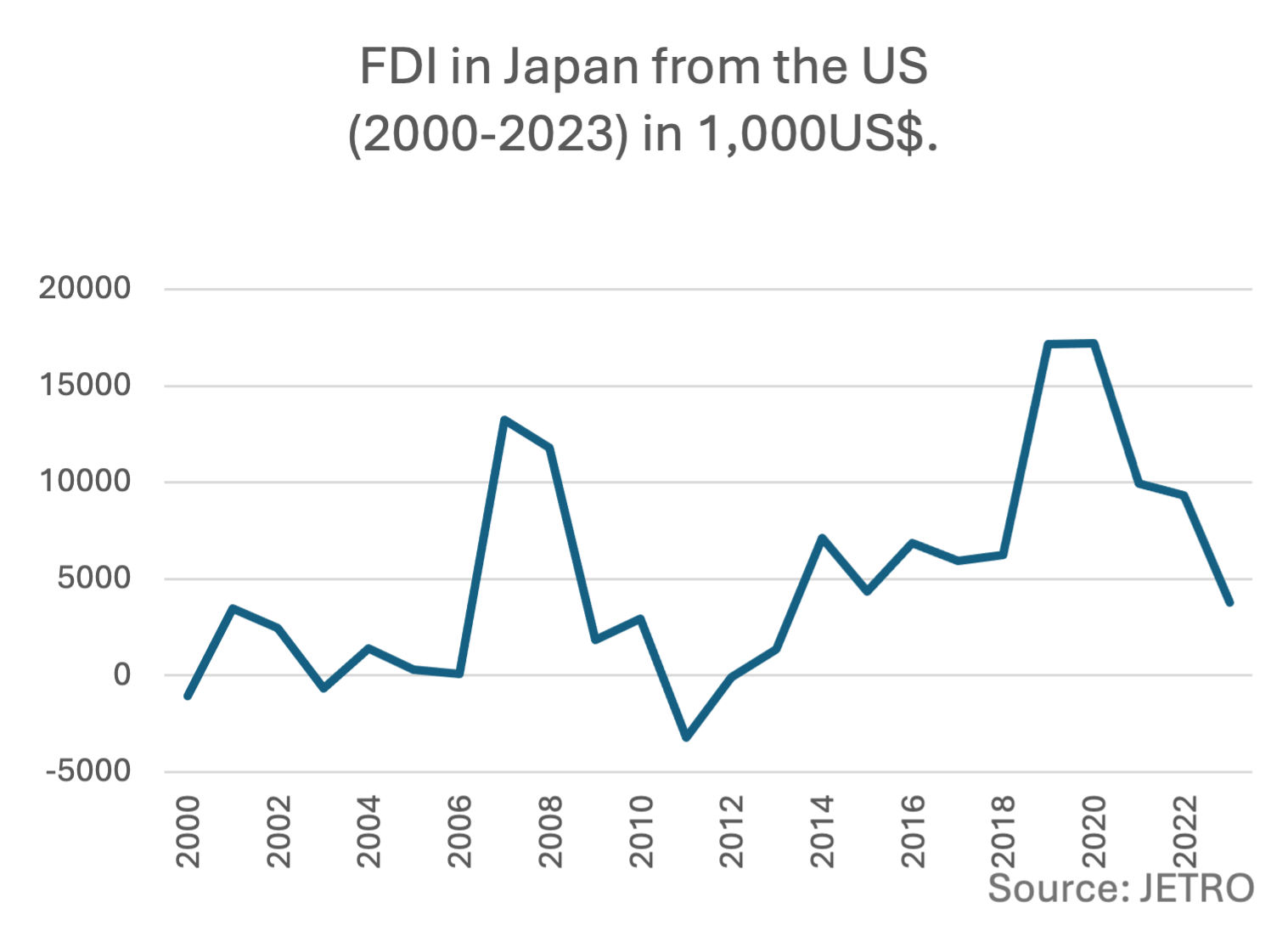

Since 2022, the United States has again become the largest foreign investor on the island, with an amount of approximately 9.3 billion USD(JETRO), equal to the previous year. This trend is not just about investment, but also about collaboration in technology and innovation. It's a testament to the strength of Japan's economy, the stability of its bilateral relations with the US, and the optimism that both countries share in facing global challenges together.

The US took it upon itself to debunk the myth of 'nearshoring' as the future of international trade in the Americas. In its place was the concept of "Friendshoring", which consists of relocating supply chains to allied countries or countries with friendly relations rather than unstable regions. Friendshoring between the two countries and Nearshoring in Mexico are strategic responses to changing global dynamics. Both seek to strengthen supply chains and reduce dependence on China, but they do so through complementary approaches. While one focuses on technological collaboration and political stability with a solid but distant ally, the other takes full advantage of the neighbour's geographical proximity and logistical efficiency. Such an approach seeks to reduce geopolitical risks and ensure the most reliable and secure supply chains. Both countries have reciprocally embraced friendshoring as part of their economic and strategic policies, following the onset of the trade war. Washington's national security concerns with the Asian dragon are about a threat regarding intellectual property theft, cyber risks, and the possibility of supply chain disruptions due to excessive fear of the emergence of a new world order.

Both governments provide incentives for companies to invest in each other's economies. These include tax incentives, subsidies and subsidies to build manufacturing facilities and research centres, in contravention of agreements reached in 1995 at the World Trade Organisation ("Prohibited subsidies are those whose granting is contingent on the achievement of particular export objectives or the use of domestic rather than imported products. They are prohibited because they are specifically intended to distort international trade and are likely to affect other countries' trade adversely" WTO). They also seek to improve infrastructure to sustain their projects, which includes developing transport networks, logistics hubs and digital infrastructure to facilitate efficient operations and thus compete with the Silk Road.

US-Japan Friendshoring is a strategic approach that aims to enhance security and economic resilience in a rapidly changing world. By collaborating in critical industries, the two nations can better navigate global uncertainties and mitigate risks, while also opening up new avenues for innovation and development.

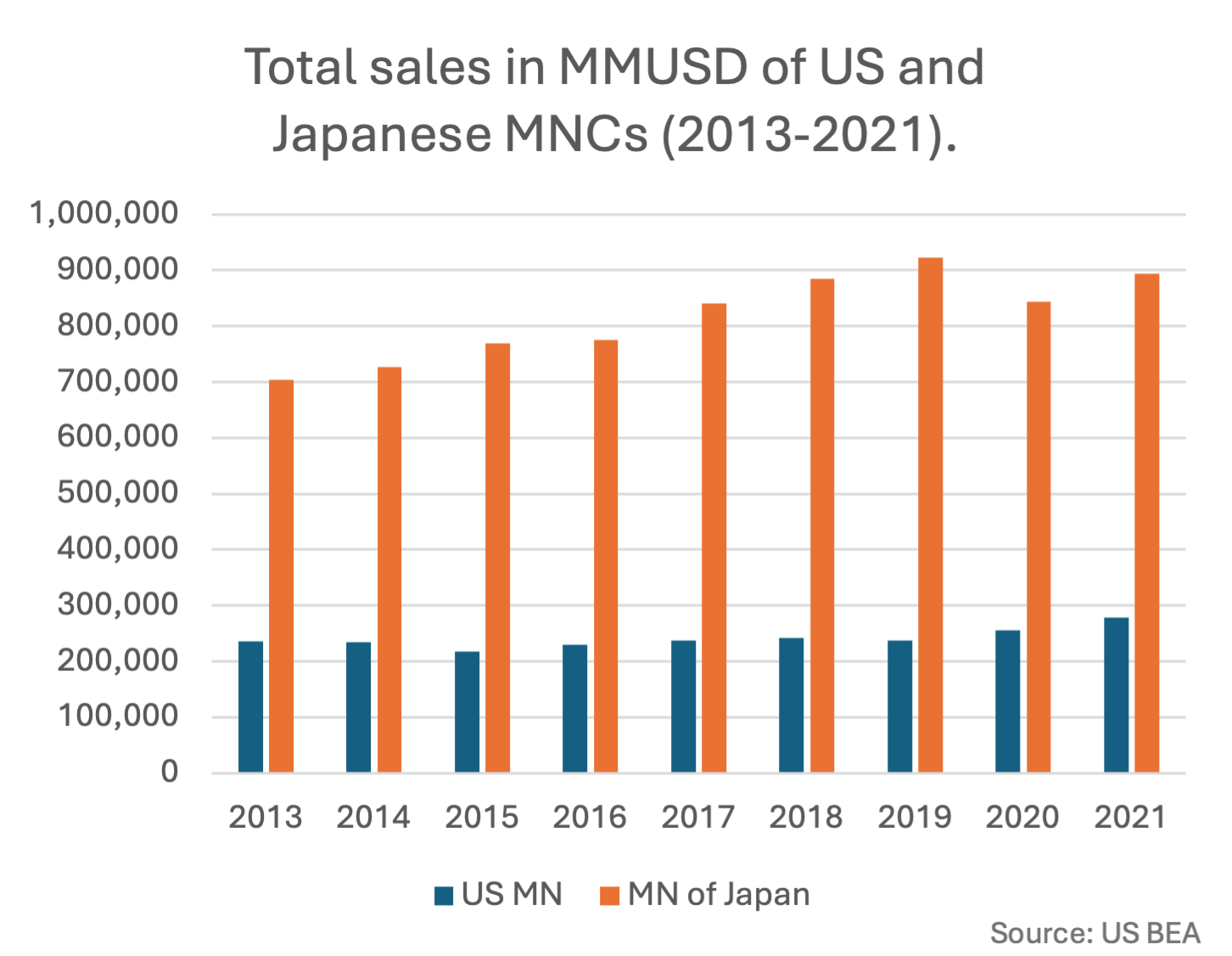

Japanese innovation and technology are world-renowned, and the idea of closer collaboration attracts more US MNCs because of their competitive advantages. According to BEA, Japanese MNCs have four times more sales than US MNCs. (see graph)

US multinational companies, with their adaptability and strategic vision, can take advantage of their partners' knowledge in this new dynamic. Not only are business strategies and FDI between these nations being redefined, but economic and political ties, affected in the 1990s when the US accused Japan of what it now accuses China of, are also being strengthened.

In conclusion, the US friendshoring of Japan is a strategy aimed at improving security and economic resilience vis-à-vis China. Given Japan's factor endowment, this alliance will enhance its technological development capacity, mitigate risks and open up new opportunities for the country of the rising sun. With this, the West consolidates Japan as a haven and strategic ally for US companies. US not only diversifies its sources of supply, but also strengthens its geopolitical position in the Indo-Pacific region. By consolidating Japan as a safe haven and strategic ally, the West ensures a robust presence in an area crucial to global trade and security. This symbiotic relationship benefits both nations: Japan receives investment and the U.S. gains technology and a reliable partner in a key geostrategic location for the future of the fragmented economy.