Latin America and the change of energy matrix

- blog de gramirez

- 3304 lecturas

The change in the energy matrix represents a profound transformation in energy production and consumption, a change that is not just necessary but urgent. This transition, which was agreed upon on 4 November 2016 with the Paris Agreement, is a significant milestone in international cooperation and is based on renewable sources such as solar, wind, hydroelectric, geothermal, and biomass. The need to reduce CO2 emissions and mitigate the effects of climate change is pressing, and this article will review the progress made in changing the region's energy supply and the development of the conflict between the two powers on the issue.

Matrix change policies

On the big stage, the world's two biggest polluters are China and the United States. However, their policies appear to be radically different, and the US policy seems to be itinerant, with Republicans betting more heavily on fossils than Democrats. Still, both focused on maintaining an essentially fossil-based automotive apparatus. Thus, in 2016, the Democratic Obama administration signed up for the Paris Agreement, and shortly after that, the Trump administration withdrew it. Biden has brought it back and given a couple of import substitution laws to boost domestic manufacturing of renewable equipment, in the face of evidence that China produces 95% of the world's solar panels and most of the world's electric transport vehicles. Meanwhile, the COP conferences are in the hands of fossil energy producers, and the G7 has done little in the right direction except for Germany, Spain and the Nordic countries.

The United States generates 42% of electricity based on fossil fuels, natural gas, coal and oil. In the total energy matrix, 81.6% is fossil-based, and its use is mainly for transport. It is very similar to Mexico, with 40% of total energy going to transport.

In Argentina in 2019, the Government of Alberto Fernández issued public policies to promote renewable energy projects and supply sufficient energy at an affordable cost. Its power is generated by fossil fuels (87.5%) and the target set was to reach 20% of the electricity supply with renewable sources by 2025 as established by Law 27.191. In 2021, of the total energy used, 12.5% came from renewable energy. Natural gas accounts for 65% of Argentina's electricity generation, hydro (18%), followed by nuclear plants (8%), turbines (7%) and solar (1%). Renewable energy (including nuclear) accounts for 34% of the electricity generated in the country. Milei's presidency has questioned the progress of the transition, is a climate change denier and has cut several environmental funds. Meanwhile, lithium extraction projects generally have capital from China, the US, and the G7.

In Brazil, access to electricity is virtually universal, and renewable energies cover approximately 45% of the country's demand, according to the National Energy Efficiency Plan, which defines goals and measures to reduce energy consumption. The official Plan was drawn up by Law 21.305 on Energy Efficiency, published in 2021, and is updated every five years. At COP26 (2021), the country announced a long-term goal of achieving net zero emissions by 2050 and a plan for a 50% reduction in carbon emissions and zero illegal logging by 2030.

For its part, Chile published 2022 an update to its Long-Term Energy Policy (PELP), which emphasises a commitment to zero net emissions and establishes a decarbonisation pathway that encompasses all sectors of the national economy. Its legislation encourages investment in generation across the electricity sector. Coal consumption fell to 15 GW and is third behind hydro and renewables (solar and wind). The weight of oil fell to 2GW, leaving power generation with a non-fossil majority. According to IEA data, 62% of Chile's energy will be renewable by 2023.

Colombia launched the National Energy Plan 2020-2050 in 2016, to kick-start its energy diversification and ensure reliable supply by promoting wind, solar and geothermal across the country. It has the Energy Transition Law (2023) that expanded policy actions and fiscal benefits to improve the efficiency of low-carbon technologies, including geothermal, carbon capture and storage (CCS) and hydrogen. Colombia's national oil company, Ecopetrol (Empresa Colombiana de Petróleos), supports the transition. Electricity generation is mostly renewable, but the energy matrix is still 64% fossil-based, and its use is mostly transport.

Mexico was the first major emerging oil-producing economy to adopt climate legislation in 2012. Subsequently, at the end of 2015, the Energy Transition Law (LTE) was published, seeking to introduce renewable energy. The energy matrix is 88.6% fossil-based, the rest renewable, while electricity generation is 74.2% fossil-based, and the difference is renewable. The largest use is transport, as in the US.

Finally, the Peruvian Government created the Energy Fund for Social Inclusion (FISE) in 2012 to bring clean energy to the most vulnerable segments of the population and help reduce energy poverty in the country. Peru does not belong to the IEA, so there is no homogeneous data to previous ones. In Peru, energy is primarily renewable (hydroelectric) and there is no transport transformation policy.

Progress on matrix change

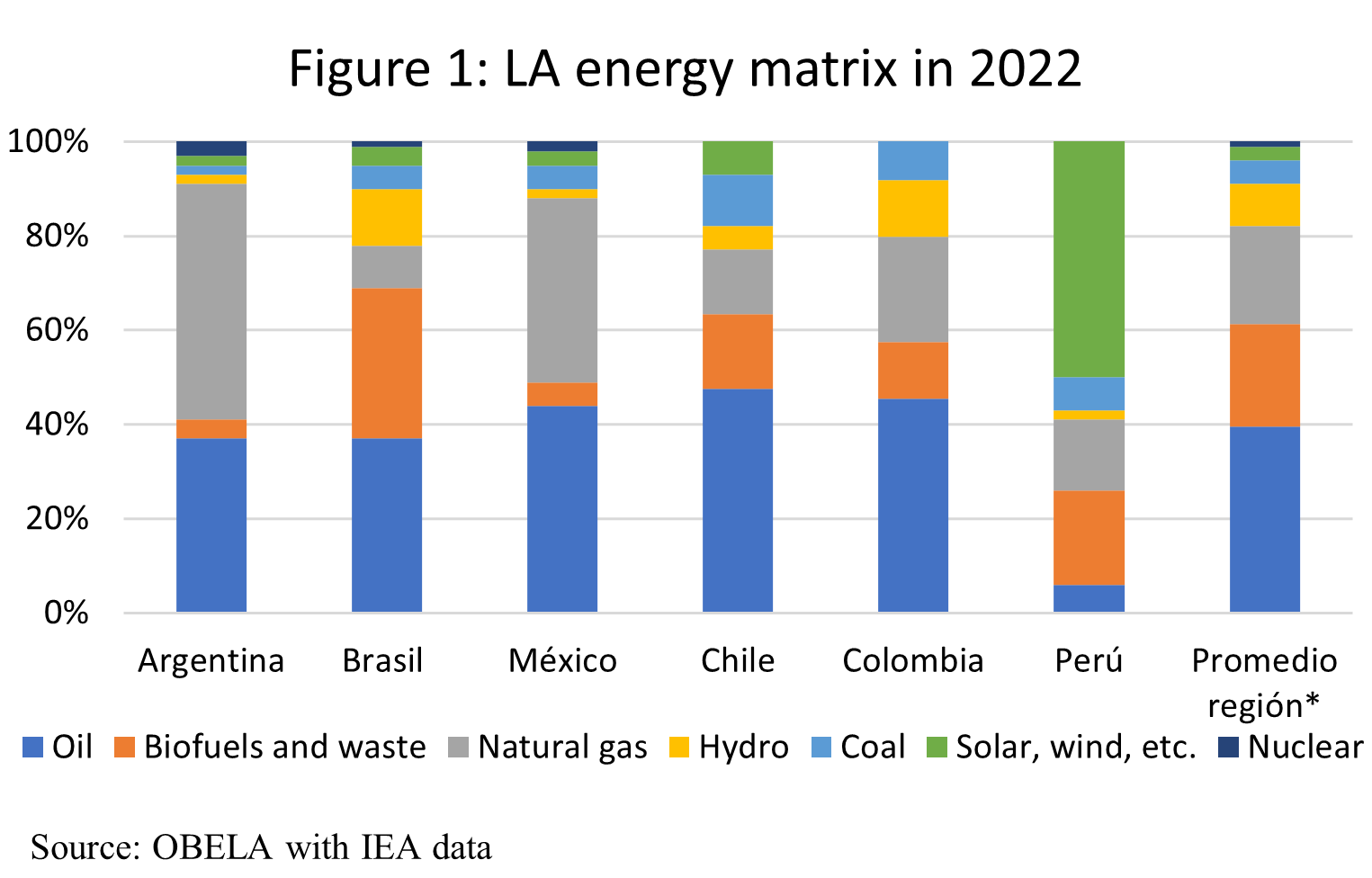

As can be seen in Graph 1, on average, countries in the region use 40% oil to generate energy, followed by bioenergy 22%, natural gas 21%, and renewables 17%, and the latter two have been increasing. The problem is that there is oil from the US to Bolivia to a greater or lesser extent, and it is fiscally costly to make the transition. In the United States, an additional problem is the weight of oil interests. In sum, renewable energy represents a smaller percentage than fossil fuels with no change in sight, except in Chile, Costa Rica, and Uruguay, countries without oil. In 2020, Costa Rica generated 99.8% of its energy from renewable sources, according to data from the Costa Rican Electricity Institute (ICE); by 2023, it was 95%, where 67% came from hydroelectric plants, which have been affected by climate change. On the other hand, in Uruguay in 2022, according to data provided by the Ministry of Industry, Energy and Mining (MIEM) through the National Energy Directorate (DNE), in the National Energy Balance (BEN), the participation of renewable energy sources reached 56% of the total supply matrix and 91% in the electricity generation matrix.

Hybrid vehicles

There are some novel variants on the transport consumption side, which is the most significant in the region. There is the hybrid use of fossil fuels with ethanol in transport. Brazil, which invented it in 1975, is a world leader in biofuels with second-generation ethanol and the manufacture of hybrid cars that provide a large domestic market. In Peru, mass passenger transport and private passenger transport (taxis) are gas-gasoline hybrids due to the low price of gas. Chinese companies have started supplying the Peruvian market with vehicles with gas tanks installed for hybridisation. The availability of gas from the Camisea field has made this energy source cheaper. It is likely to spread to countries where gas is available, in the same way that ethanol has become widespread in countries where sugar cane is available, such as the United States. In October 2024, Colombia announced the most significant gas field discovery in 45 years. The Government expects to double its gas reserves, allowing it to cover its hydroelectric supply that decreased in 2024 due to droughts.

Hybrids with electricity confront the issue of the region's predominant reduction of hydropower, especially in Brazil, Peru and Colombia due to climate change. The drought makes it necessary to consider expanding renewable energy supply in these countries in the short term.

| Table 1: Renewable sources of energy generation 2022 |

||||||

|---|---|---|---|---|---|---|

| Type of energy |

Mexico |

Argentina |

Brazil |

Chile |

Colombia |

Peru |

| Hydro |

43% |

55% |

72% |

41% |

96% |

90% |

| Wind |

25% |

32% |

14% |

18% |

0.10% |

6% |

| Solar |

25% |

7% |

5% |

31% |

1% |

2% |

| Bioenergy |

2% |

6% |

9% |

9% |

3% |

2% |

| Geothermal |

5% |

1% |

||||

| Source: OBELA with IRENA data. | ||||||

Finally, the matrix change is slow, with some countries becoming more advanced because they do not have oil, such as Chile. The lack of charging infrastructure for 100% electric vehicles points to the fact that the future of mass and private passenger transport will be hybrid vehicles of three mostly Chinese types.

Amid the conflict between the US and China on the energy issue, the US lags behind its North American neighbours. The commitment to fossil fuels, of which Mexico, Canada and the US are prodigal, is supported by other OPEC oil-producing countries facing the presence of Chinese capital in renewable energies, which is a source of conflict and disinformation campaigns. There is progress in changing the matrix, but more marked in South America than in North America, and more in countries without oil than in those with it. China's presence in energy investments will likely accelerate these changes wherever they are allowed.

Tariffs in 2024 on Chinese-made electric vehicles from 100% in Canada and the US and the elimination of Mexico's tariff exemption and solar panels from 25% to 50% in the US ensure that there will be no major change. The two North American neighbours will have to navigate the pitfalls of making their own policies outside those of the region's largest country.