China is the world's leading producer and buyer of electric vehicles (EVs) and electric buses (EBs) and has been the first to electrify its private and mass passenger transport. This fact has intensified trade disputes between China and the US, where China is the world leader. US measures (through the Inflation Reduction Act, IRA, fiscal stimulus for companies, $7,500 subsidies for EV purchases and 25% tariffs on Chinese cars) intend to protect and boost its industry. According to the International Energy Agency's (IEA) 2024 report, Chinese companies will most likely prevail in international competition, as they dominate the supply chain of all EV companies (from Germany to North America) that buy their inputs from them. The dispute in Latin America (LA), especially in Mexico, is focused on expanding their restrictive measures to the rest of the countries, trying to block the entry of competitors such as BYD.

The US measures not only limit the entry of Chinese companies but also slow down the energy transition in the region, as North America needs the technological capacity to implement it. However, in addition to EVs, mass passenger transport is also moving towards electrification. Unlike EVs, the US does not compete in the EV mass passenger transport industry, which does not exist. Proterra, a US company, produced 1,041 EVs and went bankrupt in 2023; BYD, on the other hand, has delivered more than 70,000 buses worldwide by 2023. As a result, China has an access route to world markets. While ECs are not used widely in Latin America, there are signs of a slow transition.

In this essay, we will review the policies the different Latin American governments followed, the progress made in electrifying mass passenger transport, and the Chinese's predominance in this field.

The transition process and China's presence in the world and LA

According to the IEA (2024), globally, China is the country that has made the most progress in electrifying its mass transport. As of 2022, more than 64% of its bus fleet is electric, far ahead of the West. By January 2024, in Germany, only 4.5% of public buses were electric, and in the US, 0.5%. However, EC procurement has accelerated since 2020. In Europe, registrations of new battery ECs expanded annually by 37.25% on average between 2020 and 2023 and over the last year by 53%, which shows a change in trend. However, it is still quite uneven, even without counting China.

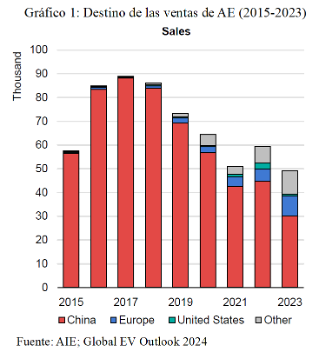

In 2023, 3% of new buses were electric; in some countries, it accounted for more than one-fifth of the total (Canada, Chile, Finland, the Netherlands, Poland, Portugal, and Sweden). That year, just over 50,000 ECs were purchased, reaching more than 635,000 in operation, of which more than 480,000 (76.4%) are in China. The low global percentage is because the USA and emerging countries do not yet have a transition policy, but it is clear that the trend is progressing. Figure 1 shows the widespread dominance of China in the market. Although global EC sales have declined since 2017, this is due to China's success in its transition. In 2022 and 2023, sales were also driven by Europe and other regions (including LA), showing that the market is on the rise and that there is a lag between the West and the Global South in the transition. Against this background, the main drivers of mass passenger transport are all Chinese companies, such as BYD, Youtong, Zhongtong, Foton and others.

In contrast to EVs, where there is evident competition between the red dragon and the US (Tesla) and Germany (BMW, Mercedes Benz, Volkswagen), the world's EV suppliers are from the East. As seen in Table 1, BYD dominates all regions outside China, even Europe, which has shown difficulties keeping up with them. Van Hool, a Belgian company, filed for bankruptcy on 8 April 2024 and was bought by the Dutch GWR group. Chinese companies such as BYD are continuing their international expansion projects. BYD is also the leading supplier in Latin America, followed by Foton (Chinese) and Youtong.

|

Table 1: Top brands of electric trucks and buses by region and origin of ownership capital in 2022 |

||||

|

Ranking |

United States and Canada |

Europe |

China |

Other regions |

|

1 |

BYD (China) |

BYD (China) |

Skywall (China) |

Youtong (China) |

|

2 |

Green Power (Canadá) |

Van Hool (Países Bajos) |

Ankai (China) |

BYD (China) |

|

3 |

Lion (Canadá) |

Solaris (Polonia) |

Farizon (China) |

TATA Motors (India) |

|

4 |

Proterra (China) |

Volvo (China) |

Shudu (China) |

Jac (China) |

|

5 |

Peterbilt (EEUU) |

Mercedez-Benz (Alemania) |

BYD (China) |

Volvo (China) |

|

Source: Prepared by OBELA with data from CATALSTART |

||||

Some LA countries have made more progress than the US and Germany in the transition of their passenger transport. As shown in Table 2, by December 2023, there were 5,084 ECs in LA, representing 5.73% of the total number of buses in the region, with the majority being battery buses, followed by trolleybuses. According to E-Bus Radar, progress concentrates on five countries (Chile, Colombia, Mexico, Uruguay, and Brazil) and five cities (Santiago, Bogota, Mexico City, Sao Paulo, and Montevideo). Chile and Uruguay stand out relatively, with electric fleets representing 21.38% and 18.7% of the fleet, respectively, well above the international average.

| Table 2: EC fleet in different countries and its global and national share at the end of 2023. | |||

|---|---|---|---|

| Country | Buses Eléctricos | Participación en el mundo | Partición nacional |

| China | 485,000 | 76.4% | 64.0% |

| United States | 5,480 | 0.9% | 0.5% |

| Germany | 1,884 | 0.3% | 4.5% |

| Latin America | 5,084 | 0.8% | 4.7% |

| México | 654 | 0.1% | 3.8% |

| Argentina | 99 | 0.0% | 9.9% |

| Brazil | 444 | 0.1% | 2.2% |

| Chile | 2,043 | 0.3% | 21.4% |

| Colombia | 1,590 | 0.3% | 11.4% |

| Uruguay | 36 | 0.0% | 18.7% |

| Total de buses | 635,000 | ||

| Source: Elaborated by OBELA with data from E-Bus Radar, PWC, IEA, Statista and Catalstart, PWC, IEA, Statista y Catalstart | |||

Unlike the EV market, where the US has deployed protectionist policies to try to develop its industry, it does not exist for ECs. Proterra, the leading US producer of ECs, began bankruptcy proceedings in August 2023 and was acquired in November of that year by Volvo Battery Solutions, which is now Chinese-owned (Geely). The North American technological backwardness is a problem for LA, especially for the Caribbean Basin (from Colombia to the North), whose articulation with them slows down their energy transition. The EPAs open a window of opportunity for the region's governments to act independently of North American interests to ensure the matrix change to push for national production of electric vehicles and join the international supply chain.

Transition policies

Despite the regional lag, various measures are in place to expand the number of EVs in circulation. According to IEA monitoring, Chile, the country with the most progress, proposed in 2021, as a 2035 target that 100% of public transport (buses and taxis) should be electric, with progress reported in buses. In 2019, Colombia passed a law to ensure that at least 10% of the bus fleet is electric by 2025, increasing 10% per year until reaching 100% by 2035, and has achieved this goal. In 2020, Argentina set a target of 30% EC by 2030 and 100% by 2050, which is behind schedule. The alignment of the Milei government in favour of the US and against China puts this goal at risk. Other countries with explicit substitution targets are Costa Rica (100% EC by 2050), Ecuador (by 2025, all new purchases of mass passenger transport will be electric) and Honduras (50% of the entire fleet by 2030). Although no explicit target exists in Mexico, different electromobility projects have been pursued, especially in large cities (Mexico City and Guadalajara), including trolleybuses, cable cars, metro, light rail and buses.

The most successful case in LA is Chile, not only because of its progress in the transition but also because it has a national EC production company, Reborn Electric Motors, which started operations in 2021 (it has manufactured 100 buses). For now, it has only two small models (24 and 44 passengers), representing a significant potential for the internal development of the electromobility industry.

The prospects for ECs and the future of transition.

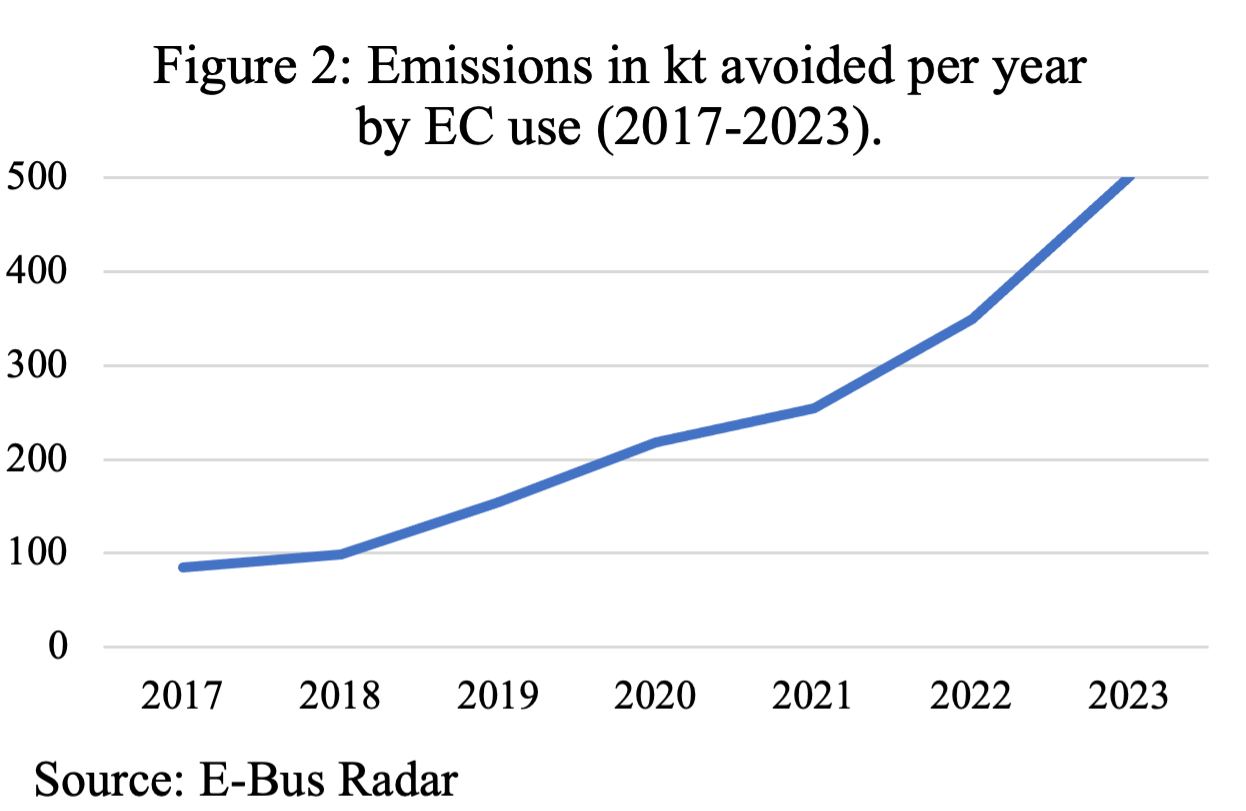

The importance of transition is critical to ensure that the region joins new transport technologies and China's leadership and combating climate change by reducing greenhouse gas emissions. Figure 3 shows the CO2 emissions avoided by introducing ECs in LA, which are increasing. Assuming an electric bus avoids 0.099 kt per year, with 5,084 buses in circulation, there were 501.6 kilotonnes (kt) fewer new emissions in 2023. Currently, if the 88,735 buses circulating in the region were all electric, 8,754.84 kt would no longer be emitted, equivalent to 2% of the CO2 emissions of Mexico or Brazil. In addition, the creation of recharging infrastructure must accompany the incorporation of electric vehicles in cities, which implies Government participation and will facilitate the electrification of other vehicles, both private and goods transport.

Therefore, if Latin America wants to accelerate its energy matrix change, it could join international supply chains, using its natural resources for batteries, such as lithium, and catch up with the US.