The reduction in the use of the dollar in international transactions and in keeping the reserves of nations, known as de-dollarisation, is not a conspiracy but rather the consequence of a series of interconnected factors reflecting changes in the global economic landscape. The declining relevance of the United States in the global economy, the growth of trade among emerging economies and the search for lower costs in international transactions are the main drivers of this phenomenon.

In 1944, the Bretton Woods Agreement determined the position of the US dollar as the world's major reserve currency. This dominance was closely linked to the post-war global economic power of the United States. Since then, the US share of world GDP has fallen from 40% to 15% regarding purchasing power parity (PPP).

The dynamics of global trade have also undergone significant changes. At the time of the signing of Bretton Woods, global exports accounted for about 10% of world GDP; today, they are about 60%. Today, US exports account for about 8% of the total, which is less than 5% of world GDP.

In 1971, President Nixon, faced with the problems of the US deficit, decided to unilaterally suspend the dollar's direct convertibility into gold and liberalise the exchange rate. Consequently, he ended the stability that the dollar agreed on under the Bretton Woods system, which redefined the international financial landscape and the relationship between the major currencies. This meant that the value of the dollar began to be determined by the forces of supply and demand in the foreign exchange market, introducing greater volatility in all exchange rates.

The end of the Bretton Woods system coincided with a process of growing trade, which has led to an increase in volume and diversification at the global level. Trade evolved considerably from the post-war period when trade flows between developed countries predominates, and prices are in US dollars.

From the 1970s onwards, central banks worldwide began to adopt the inflation targeting model, the first being Chile in 1973, and it became widespread by the 1980s, including the US Federal Reserve, to restore price stability. Although these policies achieved their objective, there is an interconnection between interest rates and the decline in economic growth. In the first decade of the 21st century, price and exchange rate stability benefited transactions in local currencies, eventually diminishing the role of the US dollar as an intermediary in international trade.

Trade between emerging economies accounts for about half of global trade. South-South trade does not need to use the US dollar as an intermediary currency; alternative currencies are available, which offer the potential to reduce transaction costs and make international trade more efficient.

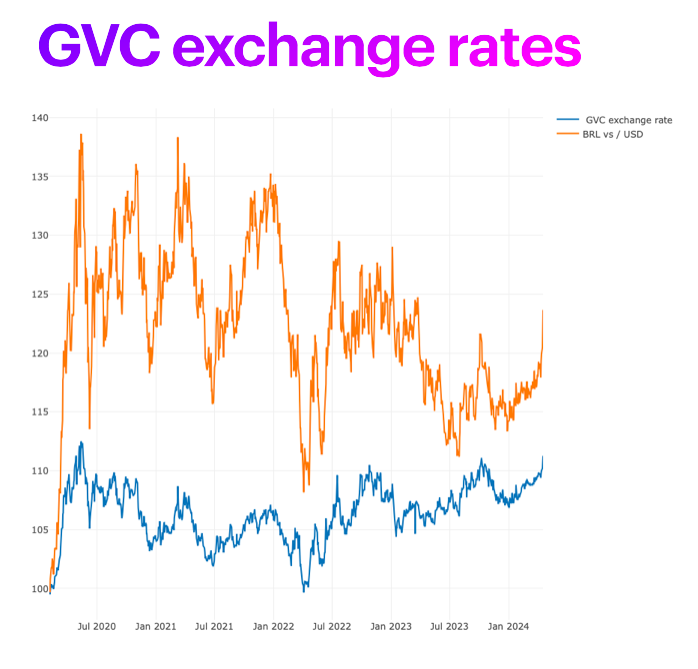

The rise of global value chains (GVCs) reshaped how products go to market. At the heart of global value chains is the fragmentation of production processes. Complex goods are no longer manufactured solely in one place. Tasks are divided and allocated according to labour costs, resource availability and regional specialisation.

This change has led to greater interdependence between economies, which participate in different value chain stages to produce a final product. This model has exposed countries to certain risks, especially regarding exchange rates and the costs associated with international transactions.

Countries with currencies that do not belong to the Special Drawing Rights (SDR) must convert their currencies into dollars to participate in international trade, which entails additional costs. Conversion takes place when importing components and when exporting goods and services—the costs of double conversion lead to the search for alternatives that reduce transaction costs.

Some countries have resorted to alternatives such as bilateral swaps, whereby central banks exchange their currencies at a pre-specified exchange rate for a given period. This strategy eliminates the need for US dollar intermediation and allows companies to transact in their own or regional currencies, significantly reducing currency conversion costs. It facilitates trade and investment between countries, which can contribute to regional economic development and economic integration while lowering transaction costs. An example is the Brazilian and Argentina Central Bank's agreement to pay in local currency in October 2008. It is the same case with the China-Brasil agreement.

Alliances between developing countries play an important role. By reducing dependence on the dollar, countries can become more insulated from large fluctuations in the US foreign exchange market and protect their financial stability. These partnerships often involve the coordination of monetary and exchange rate policies. They may include the creation of regional currencies, the establishment of development banks and the implementation of alternative payment systems.

The Southern Common Market (MERCOSUR) has explored the possibility of creating a common currency based on a basket currency [O. Ugarteche (2021)] to facilitate regional trade and reduce the intermediation of the US dollar. The outcome of this was the agreement between the Brazilian central bank and the BCA in October 2008 and then between all MERCOSUR central banks.

The Association of Southeast Asian Nations (ASEAN) has implemented initiatives to promote the use of local currencies in regional trade and reduce the use of the US dollar, such as the Chiang Mai Initiative. This multilateral currency swap arrangement allows member countries to access loans in local currencies to stabilise their financial markets, but to date, it has never been used.

The BRICS countries have established their monetary and exchange rate policies by increasingly prioritising the currencies of their members in international trade. They have established the New Development Bank (NDB), which provides loans denominated in the national currencies of the member countries, and a Contingent Reserve Arrangement (CRA) to facilitate trade and financial transactions settled in their local currencies. They also use alternative payment systems like the Chinese Cross-Border Interbank Payment System (CIPS).

De-dollarisation is not limited to trade. The rise of the Shanghai Futures Exchange (SHFE) as a global benchmark for commodity pricing marks an important step in de-dollarising the international financial system.

Traditionally, the New York Mercantile Exchange (NYMEX) is the benchmark for wholesale, US dollar-denominated trading transactions. However, the growing volume of trading on the SHFE, with contracts settled in Chinese yuan, challenges the NYMEX's hegemony.

The US sanctions fragmented the global oil market. Traditionally, oil has been traded and priced almost exclusively in US dollars. However, Russian oil is traded in roubles, and oil from sanctioned countries such as Iran, Yemen, and Venezuela, to name a few, is traded in yuan. A further example is the futures trading of lithium hydroxide (used to produce EV batteries), done on the SHFE and denominated in yuan; there is no futures market for this material in the West.

This fragmentation has several implications. It makes it more difficult for the US to use oil as a geopolitical weapon, as sanctions on the US dollar would have a less significant impact on countries that no longer rely on the dollar for their oil transactions. It also limits the US's ability to use the dollar as a sanctions tool. As more countries and companies transact in other currencies, sanctions on the US dollar will have a less significant impact.

De-dollarisation is not an orchestrated conspiracy against the United States but a natural reflection of the evolving global economic landscape. The declining economic relevance of the US, the growth of trade among emerging economies and the search for lower international transaction costs are the driving forces behind this process. The dollar's decline is leading to a more significant financial fragmentation era with its currencies and payment systems. In the future, the dollar will coexist with other reserve currencies of the global south, bringing with it a new international monetary and financial system and a new architecture.

O. Ugarteche (2021). Elementos para la cooperación financiera regional. Universidad Nacional Autónoma de México, Instituto de Investigaciones Económicas.