Oil companies and clean energy

- blog de anegrete

- 2921 lecturas

The economic crisis, the collapse of oil prices, and the energy matrix change pose a danger to the oil industry. Low profitability puts pressure on the big oil companies to change their energy production, while the environmental cost of the sector is gigantic. According to Climate Action 100+ , 40 oil companies emitted 8.8 gigatons of CO2 by 2018. It is more than 2.44 and 3.1 times than 23 mining companies or 32 electricity generation companies. According to the International Energy Agency, investment in exploration, drilling, and extraction by major Western oil companies, except for ExxonMobil and British Petroleum, decreased slightly from 2018 to 2019 by 0.3%.

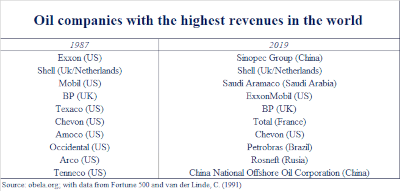

Some global oil companies appear to be turning to clean energy as a business alternative. The biggest oil company globally, Sinopec Group (China), for example, has been promoting geothermal energy as an alternative since 2015. The company proposed that by 2020 there would be 500 gigawatts (GW) of installed capacity. China National Petroleum Corporation is also interested in other types of energy, such as geothermal and ethanol. Of the latter, it can produce 500 thousand tons annually.

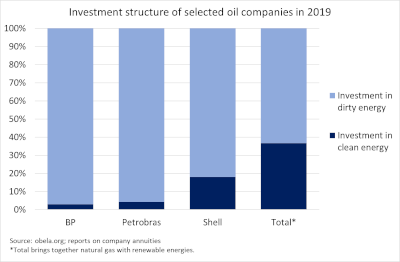

The Anglo-Dutch Royal Dutch Shell, the largest oil company in Europe and second globally, planned to invest between 4 and 6 billion dollars in the 2016-2020 period in the wind, solar, and biofuels energies as well as into the development of electric car chargers and hydrogen cars. However, by the end of 2019, they had only invested 3 billion dollars.

For its part, British Petroleum (BP) is present in the wind, solar, biomass, and biofuel energies. Their priority is the production of biofuels by joining the agro-industrial Bunge International Limited in 2019. According to plans, there should be 11 new ethanol and sugar production plants in Brazil for electricity generation. BP also has investments in chargers and batteries for electric cars. StoreDot (Israel) and FreeWire (United States) received 20 and 5 million dollars, respectively. In 2018, BP bought the English ChargerMaster for 170 million dollars, in the same business line as the two previous ones.

France's Total set itself to invest $500 million a year in renewable energy since 2015. It has concentrated on wind and solar power, the most important of which is the solar park in the Atacama Desert, Chile, with 68 MW capacity. They have also invested in biofuels and bioplastics. The investment reported by the company dedicated to non-petroleum energy is a little over 7 billion dollars for 2019.

The American ExxonMobil does not have the same trend as the other oil companies. On the contrary, the company did not present complete information on the environmental damage caused by its activities in 2015, leading investors to lose 1.6 billion dollars. In December 2019, with testimony from Rex Tillerson, former CEO of ExxonMobil and former US Secretary of State, the New York court ruled in favor of the oil company.

The situation in Latin America contrasts with the United States. The Brazilian company Petrobras, in December 2018, published a $417 million investment plan for the period 2019 - 2023 dedicated to research and development of renewable energies. It explains the incursion into the production of flexible and transparent solar panels in conjunction with the Swiss Center for Technology and Microtechnology in February 2019. However, under the new CEO, Castello Blanco, only 3% (147 million dollars) of the 2019 total investments (over 3 billion dollars) have been directed to this area. The rest went to oil production activities. Castello Blanco refuses to invest in clean energy by saying that "we are not a charity, we are not going to throw money away. We have to run profitable operations. If we don't generate cash, we won't do anything about climate change."

Contrarily, Colombia's Ecopetrol has already made a foray into clean energy with the Castilla solar park in Meta, Colombia, and a generation capacity of 21 MW, inaugurated in October 2019. In late 2019, they announced a 200 million dollar investment in clean energy in 2020. It has focused on solar energy with two solar parks, expected to become operational in 2022. These will be near an oil field and will serve for the plant's power generation.

Petroperu has just opened the door to clean energy in 2020. The oil company president said: "(...) in Petroperú we are going to explore how to migrate to other energies and become a company that explores those opportunities". Other Latin American companies, such as YPF (Argentina), PEMEX (Mexico), Yacimientos Petrolíferos Bolivianos (Bolivia), have not yet taken a position on this issue.

Oil companies need to look for new ways to be profitable and to maintain the environment. With this in mind, many of the firms proposed investments in renewable energies. However, evidence shows that the efforts of the oil industry to enter green energies are not enough. If one compares clean energy investments against total investments, it is very stark. For example, the percentage for BP and Petrobras is no more than 20%. The trend remains constant since these efforts began, and fossil fuel investments are still much higher