The year 2023 has brought an evident fracture in the global landscape, dividing the world into two contrasting realities. Initially, predictions for this year pointed to the United States entering a recession due to rising interest rates aimed at curbing inflation. The IMF expected the recession to affect Mexico, Central America and Colombia, regions closely linked to the economic dynamics of the North. On the other hand, South American countries with stronger ties to China were to continue to experience steady but moderate growth.

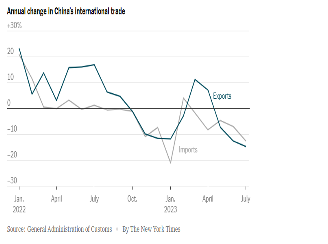

CHINA'S FOREIGN TRADE 2022 -2023

However, these forecasts have yet to materialize as expected. Despite the considerable increase in interest rates, the United States has yet to fall into recession. Paradoxically, China has experienced an economic slowdown. The United States maintains a high inflation rate, while China has managed to keep its inflation close to zero, even recording a slightly negative month.

This economic divide in the two major markets has triggered a new reality. The critical question is: What has led to China's slowdown? Looking at the economic conflict between the United States and China, characterized by aggressive measures and mutual retaliation, one can understand the decline in bilateral trade. Chinese exports have declined since implementing these measures, falling by 20% between the end of 2021 and mid-2023. Despite this, China has maintained a monthly trade surplus in the vicinity of $75 billion.

This phenomenon has impacted Chinese imports, which have contracted by 30%, mainly from not purchasing integrated circuits from the United States. This decline affects the microchip and electronics industries in the Pacific coastal regions. The measures that have impacted China's growth have had a similar effect on the U.S. economy. Still, with a crucial difference: while China's exports accumulate surpluses, the U.S. continues consuming and consolidating a considerable external deficit.

Notably, U.S. dependence on Chinese imports has declined by 2%, according to UNCTAD data for 2022-2023, while China's dependence on U.S. imports has declined by 0.9%.

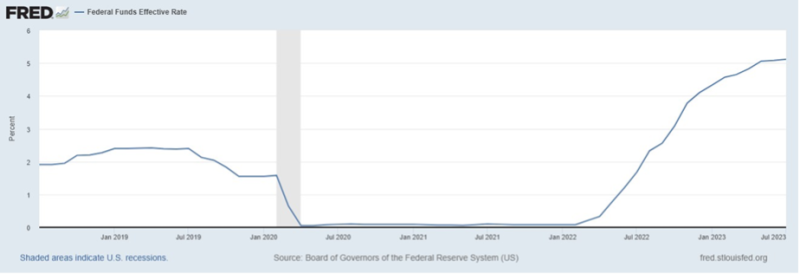

Inflation in the United States and its containment policies, including interest rate increases, have also influenced trade between these two powers. In contrast, China does not face inflationary problems and maintains its prices close to zero variation, with the possibility of even deflation. It is due, in part, to advantageous trade agreements with Russia to purchase oil and food at reduced prices.

According to the IMF, this situation has allowed China, being insulated from the effects of interest rate hikes by the U.S. Federal Reserve, to forecast growth of 5.2% for 2023. In contrast, the United States' forecast is to grow by only 1.8% and the European Union by just 0.9%. Russia will grow 1.5%, war notwithstanding. Mexico has a rate closer to 3%, and South American countries have cooled more than expected due to the drop in Chinese trade.

U.S. FEDERAL FUNDS RATE 2018-2023.

It is crucial to highlight that, despite these IMF projections, the Western media continue to focus on China's crisis and exaggerate the boom in the West, distorting the actual reality. The United States faces a fiscal deficit of 5.3% of GDP in 2023, limiting its capacity for growth. Public debt, which exceeds 120% of GDP, represents a challenge similar to Europe's. Rising interest rates directly impact public spending, and the adjustment needed to maintain the fiscal deficit at 5.2% (instead of the 10.4% induced by the interest rate effect) falls on public investment. This budgetary adjustment becomes more complex when consider

ing that Congress cannot reduce military spending due to national security reasons.

Although military spending generates profits for companies in the sector, it does not contribute significantly to the country's economic growth since its impact on the overall economy is limited. The arms industry, which Samuelson put at the antipodes of domestic industries (butter or tanks), no longer serves as an engine of the U.S. economy and fuels that of China.

In conclusion, 2023 has presented a world divided into two contrasting economic realities. The United States and China, the leading players in this duality, have different paths and truths despite what the Western press says. They face unique challenges and opportunities that will shape the course of the global economy in the coming months. U.S. protectionism versus China's liberalism is part of the new scenario, while the U.S. seems to grow slowly with high inflation, and China is the opposite.