The trade war between the great powers, the US and China, which began in 2016 under former President Trump and later under Biden, has exposed the loss of US competitiveness, especially in the transport industries, such as the automotive and aeronautics sectors. Chinese companies dominate new industries related to electric cars (EVs), while in conventional combustion cars (CA), the leaders are Asian (mostly Japanese) and German. The American company Boeing, one of the leading aircraft producers, has been in crisis since 2018, as its aircraft have had multiple accidents and scandals regarding their quality. It reflects the loss of the presence of these companies in Latin America (LA). Automotive linkages are increasing within Asia. In aeronautics, Boeing maintains a relevant place. Still, its recent difficulties open the door for the Brazilian company Embraer and China's Comac, which have shown signs of growth in 2024, to fill the void left by the US company.

In this article, we will review how the US has lost relevance in the transport industry in the region while the Asian ones are on the rise, as well as the relevance of Embraer and Brazil's productive capacity to compete in the area and beyond.

Competition in the automotive sector

In August 2024, in different news media, in Spanish and English, the specialised press published that Chinese automotive companies were the leading suppliers in LA, with a market share of 20%. It is not valid. The data cited in the stories come from the International Trade Centre, which refers to car exports from China to LA, which are, in fact, a fifth of LA's car imports. China exports cars from companies of Chinese origin, including American, Japanese and German companies that produce in its territory. As we shall see, despite the growing importance of Chinese firms, they still do not rule the LA market. However, the press misleadingly understands the importance of the Red Dragon as the world's workshop, which is part of the loss of US power since all car companies manufacture in the Asian giant.

While Chinese companies are not the leading suppliers, it is not the US that rules the market, but Asia. Table 1 shows car sales in different countries and their top three suppliers. US companies only dominate in their own country and Canada, not even in Mexico, their leading trading partner, where the main brand sold is Japanese (Toyota). LA's three largest car markets are Brazil, Mexico and Argentina, where Japanese, German and French companies share the market. The presence of the Red Dragon does not appear directly but through the factories in its territory. In this context, the car market is dominated directly by Japan and indirectly by China. In terms of trade flows, the Monroe Doctrine is under siege.

| Table 1: Main markets (units sold) of combustion vehicles and leading brands by country in 2023. |

|||

|---|---|---|---|

| Country |

Cars sold |

Main brands and units sold |

Country of the brand |

| China |

30,094,767 |

Volkswagen 2,495,337 |

Germany |

| Toyota 1,908,334 |

Japan |

||

| Geely 1,421,522 |

China |

||

| USA |

15,604,278 |

Ford 1,904,174 |

USA |

| Toyota 1,890,933 |

Japan |

||

| Chevy 1,715,625 |

USA |

||

| Mercedes 278,143 |

Germany |

||

| Audi 249,268 |

Germany |

||

| Brazil |

2,309,243 |

Fiat 405,723 |

France |

| Volkswagen 290,636 |

Germany |

||

| Chevrolet 274,122 |

USA |

||

| Mexico |

1,363,774 |

Nissan 244,327 |

Japan |

| Chevrolet 185,462 |

USA |

||

| Toyota 105,221 |

Japan |

||

| Argentina |

449,782 |

Toyota 94,271 |

Japan |

| VW 57,875 |

Germany |

||

| Renault 52,415 |

France |

||

| Source: OBELA, with data from the factory warranty list |

|||

The loss of US competitiveness is global. Table 2 summarises the sales (in units) of the top 15 automotive companies by country of origin. In 2023, the US ranked third with a market share of 18.6%, behind Germany with 21.4% of the market and Japan with 29.8%, which has a 60% higher market share than the US. China is barely on the rise in this industry, with a share of 6.3%, almost double that of French companies, with a significant rise.

| Table 2: Consolidated sales of the top 15 global brands by country in 2023 |

||

|---|---|---|

| Country |

Units sold |

Market share Top 15 |

| Japan |

19,935,924 |

29.8% |

| Germany |

14,288,093 |

21.4% |

| USA |

12,410,602 |

18.6% |

| South Korea |

7,302,451 |

10.9% |

| Netherlands |

6,392,600 |

9.6% |

| China |

4,239,568 |

6.3% |

| France |

2,235,345 |

3.3% |

| Total, top 15 |

66,804,583 |

|

| Source: OBELA, with data from the factory warranty list |

||

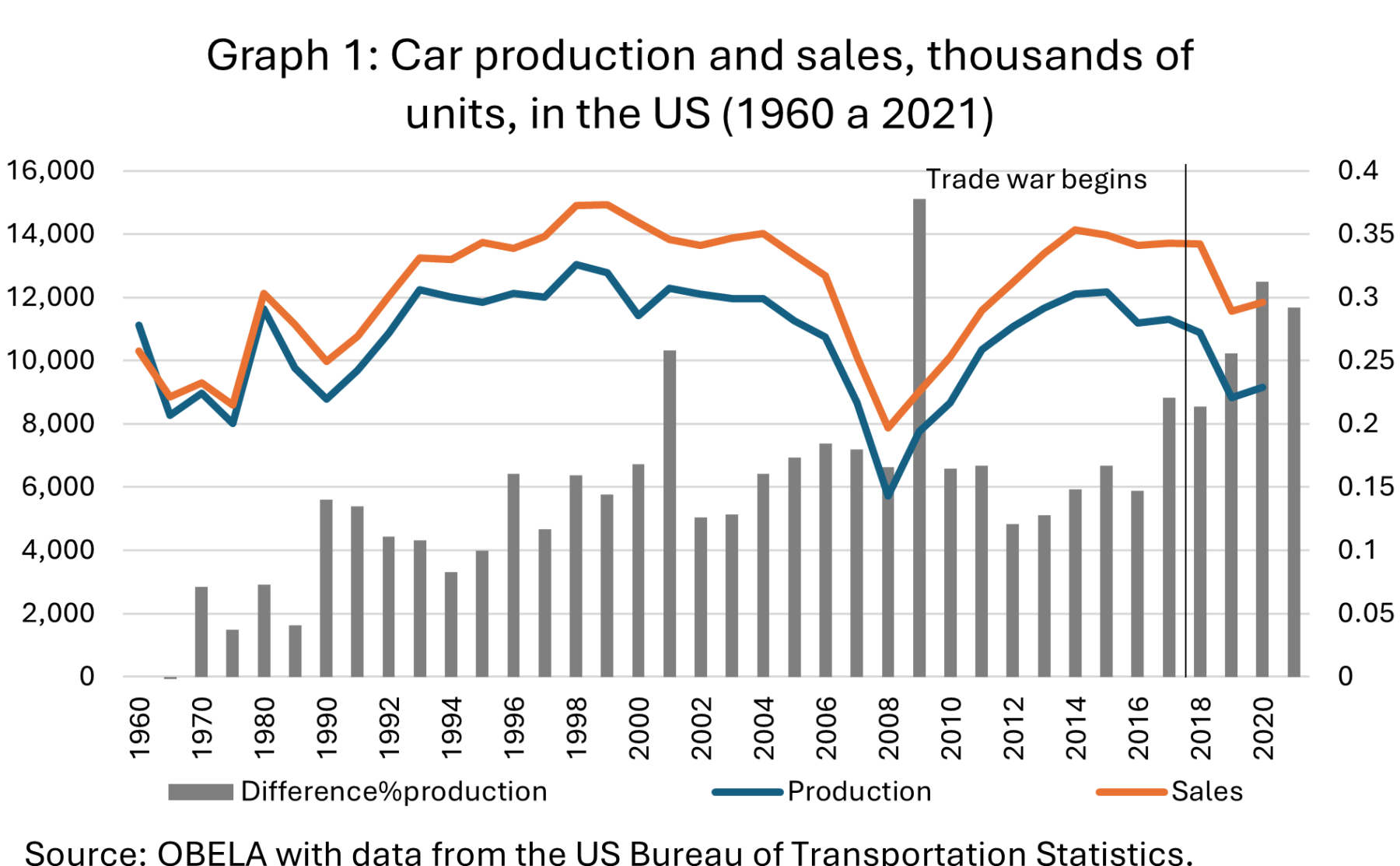

The above trajectory is not the result of mismanagement in recent years but a historical process. Graph 1 shows how car production in the US had declined since the end of the 20th century, with the lowest point occurring in the 2008 crisis when its most prominent companies, Ford and GM, were rescued from bankruptcy and Crysler declared bankruptcy. After that, there was a rise until 2014, then a continuous fall, which shows that the trade war started by Donald Trump has not yielded the expected results. The US is getting smaller and smaller in terms of productivity. It is also clear that the gap between sales and domestic production is widening, which is explained by US companies exporting to China. The phrase 'what is good for GM is good for the US', once a truism (in the 1960s), is today an anachronism.

Aeronautics industry

A more unmistakable sign of the US decline in the transport industry is the Boeing crisis, which began in 2018, when a 737 MAX 8, barely two months old, crashed in the Java Sea in Indonesia, leaving 189 dead. , of the same model, in Ethiopia, leaving 157 dead. The cause was a deficient production process. In January 2024, a plane lost part of its fuselage in mid-flight, among other incidents. Also, a Boeing Starliner spacecraft has been stranded in Earth orbit since late June and is unable to return before February 2025. Although the astronauts' lives are not compromised, they will have an excessively long stay of eight months, in contrast to the usual six months.

Boeing's difficulties are production-related. Failures have been found in quality control, as well as in the materials used in its production, which have led to failures in the structural components of the aircraft. The Federal Aviation Agency (FAA) has opened several quality investigations into Boeing, where former workers have reported that the company, while aware of the problems, has deliberately ignored them. The FAA is also investigating the purchase of poor-quality titanium from uncertified suppliers. Boeing has pleaded guilty to crashing its planes in previous years. Between 2019 and 2024, the company's market value has fallen 45%. The US government will need to bail it out because it is a large corporation (too big to fail).

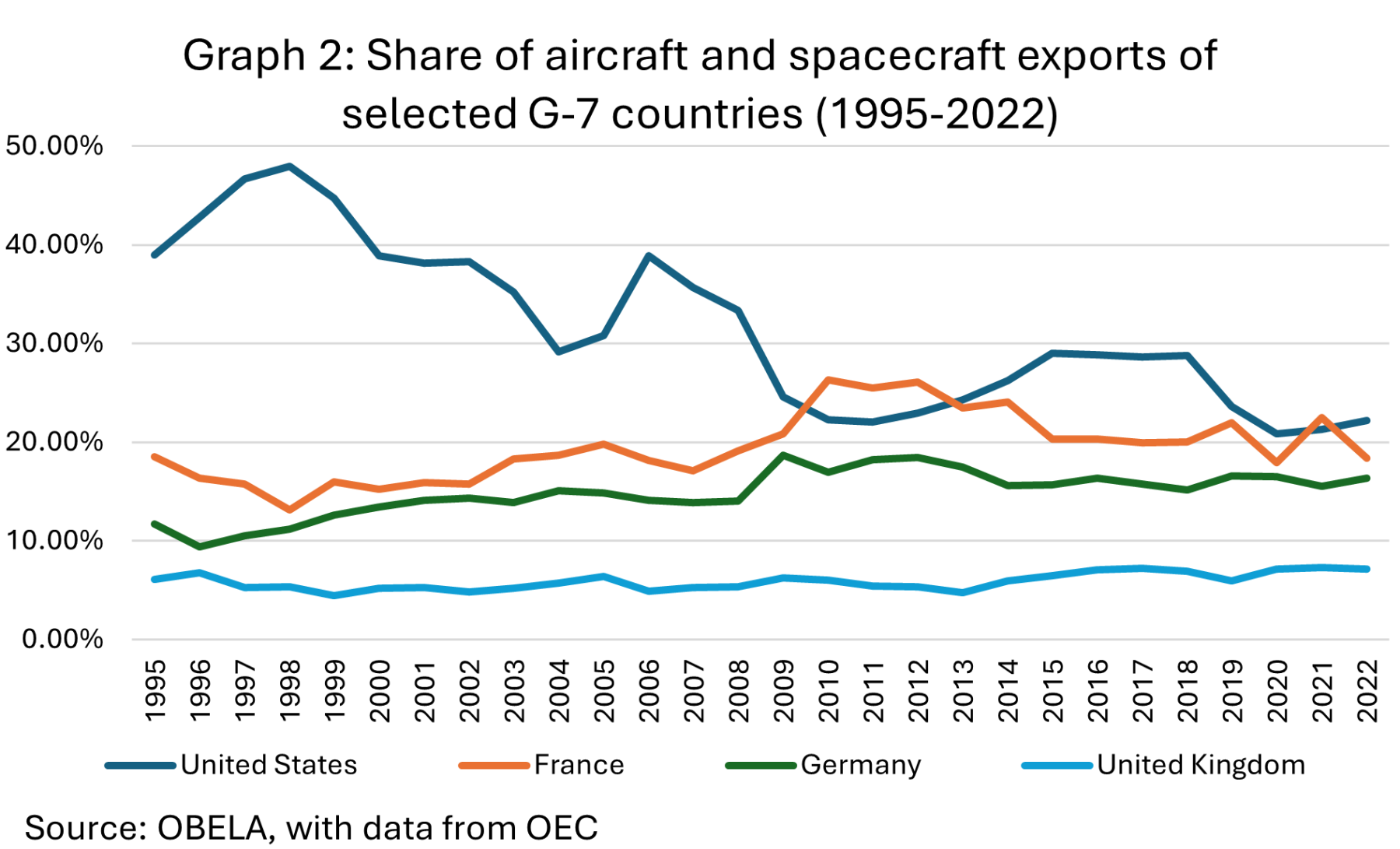

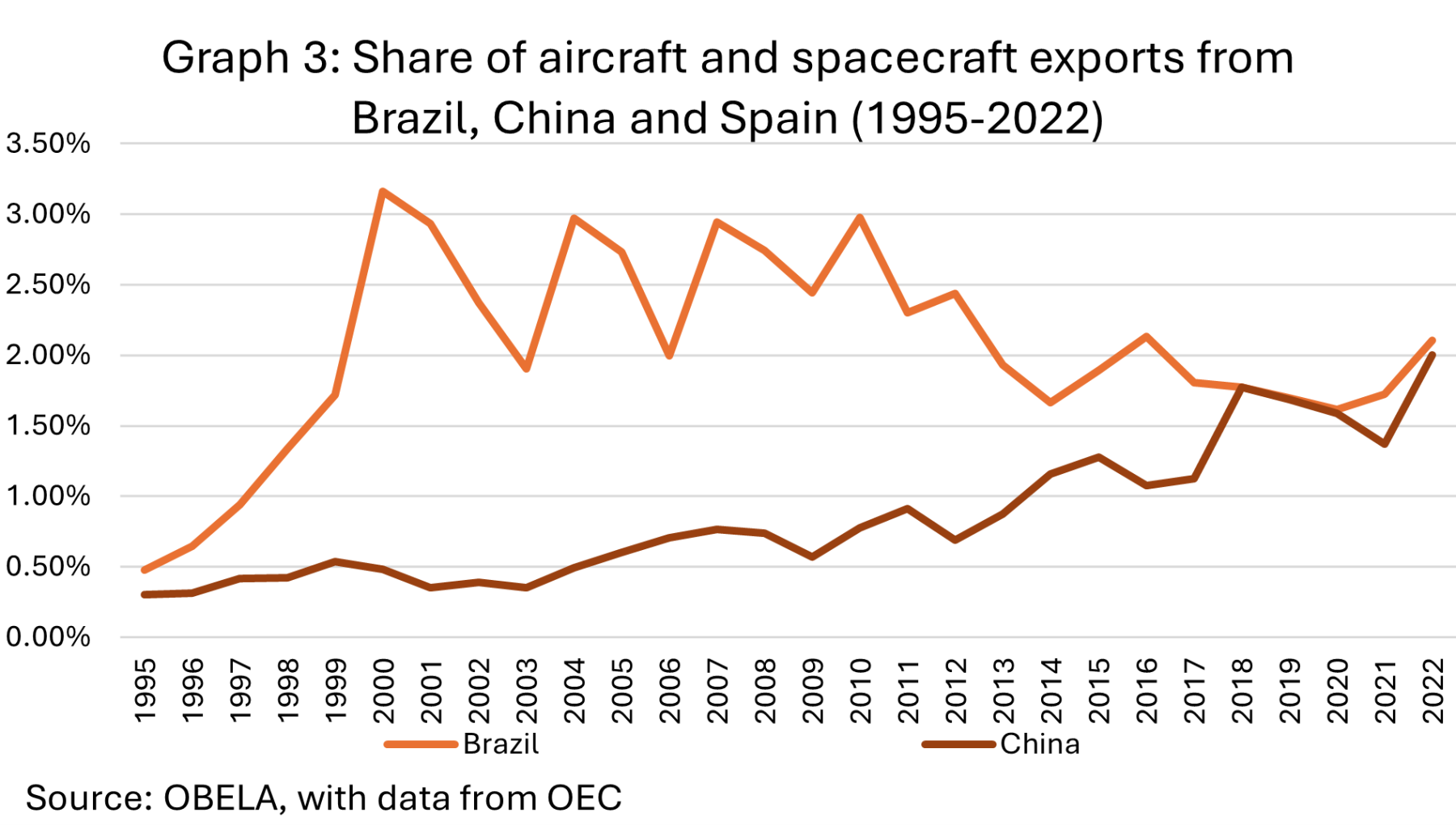

It has led to a decline in US aircraft production, as shown in Graph 2. In 1998, the US exported almost half of the world's aircraft (47.98%); by 2022, it contributed only 22.16%, a drop of more than 50%. France absorbed part of the market share through Airbus, which went from 13.14% to 18.36% in the same years, and Germany increased its share from 11.17% to 16.35%. Other countries, such as China, although with a small market share, have steadily increased their market share in the same period. China, which was non-existent in the aircraft market in 1995 (0.30% share) in 2022, produced 2% of the market and is on the rise. Brazil, with ups and downs, is also around 2% of the market, but with signs of expansion.

Embraer, a Brazilian company founded in 1969, is the third largest producer of passenger aircraft, behind only Boeing and Airbus. Since 2023 and up to August 2024, it has grown at record levels, with the expectation that this trend will continue. In the second quarter of 2024, it increased its orders by 88%, leaving its order backlog at USD 21.1 billion, a 7-year high. Between January and August 2024, the value of its shares grew by 210% and reached an all-time high. The growth results from Boeing's declining production and uncertainty about its future. It is also expanding into the Chinese market, which is generating favourable expectations due to the increased air traffic in the Asian country. In addition, Embraer has signed contracts with the state-owned Mexicana de Aviación for 20 aircraft, expected to cover the Mexico-US routes. Between 2018 and 2020, Boeing raised the possibility of creating a joint subsidiary with Embraer from Brazil. Still, it was impossible because the former considered that the Brazilian company had not fulfilled its part of the agreement.

Comac, a Chinese company, announced in June 2024 that its C919 aircraft will make its first international flight on an Eastern Airlines (EA) flight. Comac has been selling aircraft to EA since May 2023, with orders totalling 100 units. It comes in addition to other Chinese companies' orders, which total more than 1,000. The C919 competes directly with the Boeing 737 Max 8 and Airbus A320 neo, the three similar in size, in number of passengers, 192, 189 and 195, respectively, and in range, the first with 5,500 km and the others with 6,500 km. The relevant difference is the price, with the Asian aircraft costing USD 108 million, compared to the Western range of USD 110 to 120 million. Unlike Embraer, Comac can fill the gap left by Boeing Max.

In conclusion, US transport companies must gain more competitiveness in the global market due to their technological backwardness. Asian companies such as Toyota, Honda, Kia, and Hyundai, as well as, to a lesser extent, Germany's Volkswagen, took over the car market. Indirectly, China dominates the automotive market, as all companies manufacture on its territory, which has turned it into the world's workshop. With increasing difficulties, Boeing still dominates the aeronautics market, opening a field of action for Asian and Latin American companies, such as Comac and Embraer. In the commercial field, America is no longer for the Americans.