The role of lithium in trade warfare

- blog de anegrete

- 5764 lecturas

The change in the world energy matrix plays an important role in the trade war and the dispute for hegemony. While the US wants to conserve oil as an energy source, and its main export, China is changing its energy matrix and pushing clean energy at lower prices on the world market. In this context, lithium plays an important role, as the main input for batteries, including those for electric cars.

The second field of conflict is that of electric vehicles. China has mass-produced electric buses and exports them to Latin America, already in ten major cities: Mexico City, Havana, Medellín, Cali, Guayaquil, Santiago, Buenos Aires, Montevideo and San Pablo. The United States has not modified its diesel buses. The production of Chinese electric scooters and motorcycles has invaded the world market with 28 manufacturing companies, while the United States has two, Italy 5, and Germany arms Asian scooters (small motorcycles) and owns three firms. China manufactures 30 million electric scooters a year and continues to manufacture gasoline motorcycles with two-stroke engines, as does the United States which has two firms; Z-electric and Harley Davidson. Japan, China, India and Italy concentrate the bulk of world electric scooter and motorcycle manufacturing with China being the largest.

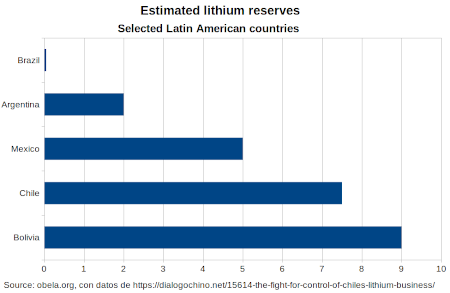

For electric vehicles, lithium is essential because of the batteries and the alloy that is made with lithium water to lighten the weight of the metals and make them more autonomous. Lithium is an alkaline metal that can be found in two ways on the planet: in salt flats and in hard rock deposits. The three countries with the most lithium not yet extracted are Argentina, Bolivia and Chile. On the other hand, the countries with the most lithium reserves are Chile, Australia, Argentina, Bolivia and China.

There is a difference between South American Lithium and the rest of the world. South American lithium is in salt flats, so it is easier to extract. With this, the mining projects of Chile and Argentina in salt flats are more productive than those of Peru or Brazil in rock mountains. It should be clarified that the U.S. Geological Survey does not take into account extractable lithium for Bolivia when there are already small exports to China and Russia. Bolivia has the largest salt flat reserves of lithium in the world, followed by salt rock mines in Macusani, Peru.

As for international trade, China is the largest importer of lithium extracted from salt flats in the world, with 269 million dollars. Of these, 75% are of Chilean origin and 12% are Argentinean. The largest exporter of lithium extracted from salt flats is Chile and of lithium extracted from hard rock is China.

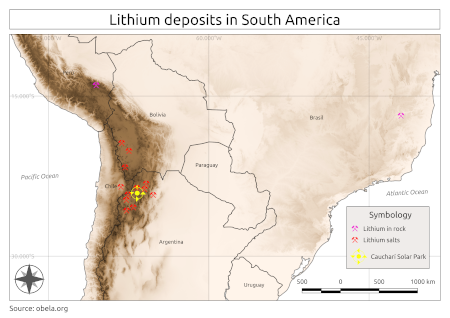

The geographical area from which lithium is extracted in South America is known as the Lithium Triangle, and is made up of three points: the Salar de Atacama (Chile), the Salar de Uyuni (Bolivia) and the Salar de Hombre Muerto (Argentina). With the increased demand for lithium from this triangle became a corridor. Now in the region there are 9 mines and it stretches from Puno, Peru to Jujuy (see map). It is not a triangle but rather, a corridor.

The Salar de Atacama in Chile is one of the most productive lithium projects in the world. The two companies in charge of extracting lithium in Chile are: Albermale Corporation, a U.S. chemical company, and Sociedad Química y Minera de Chile (SQM), a private mining company working in the Salar de Atacama and Salar del Carmen. There are also 5 projects by SQM, Albermale, SIMCO SpA (Chile) and Minera Salar Blanco (Australia) by 2021.

The American company Ensorcia Metals Corporation is in the process of investing 400 million dollars to open and operate two lithium battery plants; one in Chile, which plans to start operations in 2021, and the other in the area of Jujuy in Argentina. According to the newspaper El Mercurio de Santiago, dated January 21, 2019, Ensorcia Chile is linked to the U.S. businessman Daniel Layton, the creator of MU technology and lithium expert John Burba (of IBAT) and the Chilean entrepreneur Ricardo Donoso. With an investment of 220 million dollars they should start producing batteries in the last quarter of 2019.

On the other hand, the extraction in Argentina is on the part of the companies:

- Orocobre, an Australian mining company that, for this project has 25% participation of Toyota that works in Olaroz, Jujuy.

- Advantage Lithium, a Canadian company that works in Cauchari, Antofalla, Incahuasi, Guayatayoc and Salinas Grande Salar.

- Ganfeng, a Chinese lithium mining company working in Cauchari and Olaroz.

- Minera de altiplano a subsidiary of FMC Corporation which is a U.S. company working in the Dead Man's Salt Flats.

- Galaxy Resources, an Australian company working in the Dead Man's Salt Flat.

- Minera Exar, a subsidiary of Lithium Americas, a Canadian company that works in Cauchari and Olaroz. Mitsubishi and Magna Batteries are part of this project.

The energy of these companies, from the end of 2019, will be generated by the solar park of the government of Jujuy with Chinese technology.

In comparison, in Bolivia the extraction of lithium is by Yacimientos de Litio Bolivianos, which had an agreement signed in December 2018, with the German company ACI Systems GmbH for the manufacture of lithium batteries through a joint venture that operates with lithium from the Salar de Uyuni through an investment of 1,300 million dollars. The agreement was cancelled by President Morales to placate Potosí protests in November 2019. The German company reacted by saying that the contract was signed and would be respected. There is also the extraction of lithium and agreements with the Chinese company Xinjiang TBEA Group Company for the industrialization in the Salar de Coipasa and the Salar de Pastos Grandes to produce lithium batteries and light metal. The agreement with China has not been cancelled, totaling 2,390 million dollars, and involves the construction of the lithium industrialization plant in Coipasa, Oruro. This will demand an investment of 1,320 million dollars for the installation of five plants: one of potassium sulfate, with 450,000 tons per year (t/y); one of lithium hydroxide, with 60,000 t/y; one of boric acid, with 60,000 t/y, one of pure bromine, with 10,000 t/y, and one of sodium bromide, with 10,000 t/y. The construction of a battery plant in China is also planned, with 51 percent for YLB and 49 percent for TBEA-Baocheng.

In the salt flats of Pastos Grandes, in the department of Potosí, the investment reaches 1,070 million dollars, where three plants of lithium chloride, lithium carbonate and metallic lithium will be installed.

With respect to the second type of lithium, that housed in rocks, the projects are smaller and less productive. In Peru, lithium was found in hard rock in Puno that will be extracted by the Canadian mining company Plateau Energy. And in Brazil it was identified in Araçuaí that will be extracted by the Brazilian Lithium Company.

In September 2019, the White House advisor and daughter of the president of the United States visited Purmamarca in Jujuy, where she announced the investment of 400 million dollars by American companies with the support of OPIC for highways, particularly national routes 7 and 33. Eighty percent of the planned investments are to repair and expand Corridor C, which connects the provinces of Buenos Aires, Santa Fe, Córdoba and Mendoza. There are US$400 million in roads undoubtedly related to the exploitation of the lithium mines and collateral activities. There, in Jujuy, is the Cauchari solar park that covers an area of 800 hectares with 1.2 million solar panels that will serve for the extraction of the five lithium mines in that area. Ivanka Trump's visit was made with the company of 2,500 Argentine federal agents who arrived for military training in the northern part of the country.

South America is a disputed territory fostered now by lithium as a strategic resource, as it was before the saltpeter that led to a war in the nineteenth century between the same countries now mentioned. The coup d'état in Bolivia, orchestrated by the United States, is strongly related to the industrialization advances supported by China and Germany based on lithium. That may explain the early recognition by the United States of the de facto government and the European Union. The nation that controls the supply of lithium batteries in the world will control the change of energy matrix and the new automotive industry.