The Keynesian premise of international finance was to allow rich, surplus countries to finance the economic development of poor, deficit countries. For some time now, this has not been the case. In the following, we will analyse the enormous debt of the developed countries and their relationship with their developing country creditors. For example, the G7 is the group of debtor countries in the G20, and the other 12 are emerging creditor countries with ample international reserves. The EU as a block is not taken into account here.

The G7 countries are no longer the seven largest economies in the world, measured in PPP. Only the United States, Germany and Japan remain in that position. At the same time, they have a combined public debt of more than $50 trillion in 2023. The enormous debt of the G7 countries is a significant burden on their economies, as seen in the discussion in the US Congress on the debt ceiling and in the European Council on fiscal spending ceilings, all of which have debts over 100% of GDP. These countries must allocate a large part of their fiscal budget to interest payments on their debt (4% of GDP or more), leaving them with less money to spend. Rich countries want to have the cake and eat it too. The result is that public deficit are in the neighbourhood of interest payments on GDP

In the US, public debt finances spending on health care, education and infrastructure, wars, tax cuts and other government programmes through treasury bonds. While some of it influences economic development, much is unproductive and does not help drive economic growth. The G7 countries have been experiencing slow economic growth for many years. This slow growth makes it difficult for these countries to repay their debt and finance economic development.

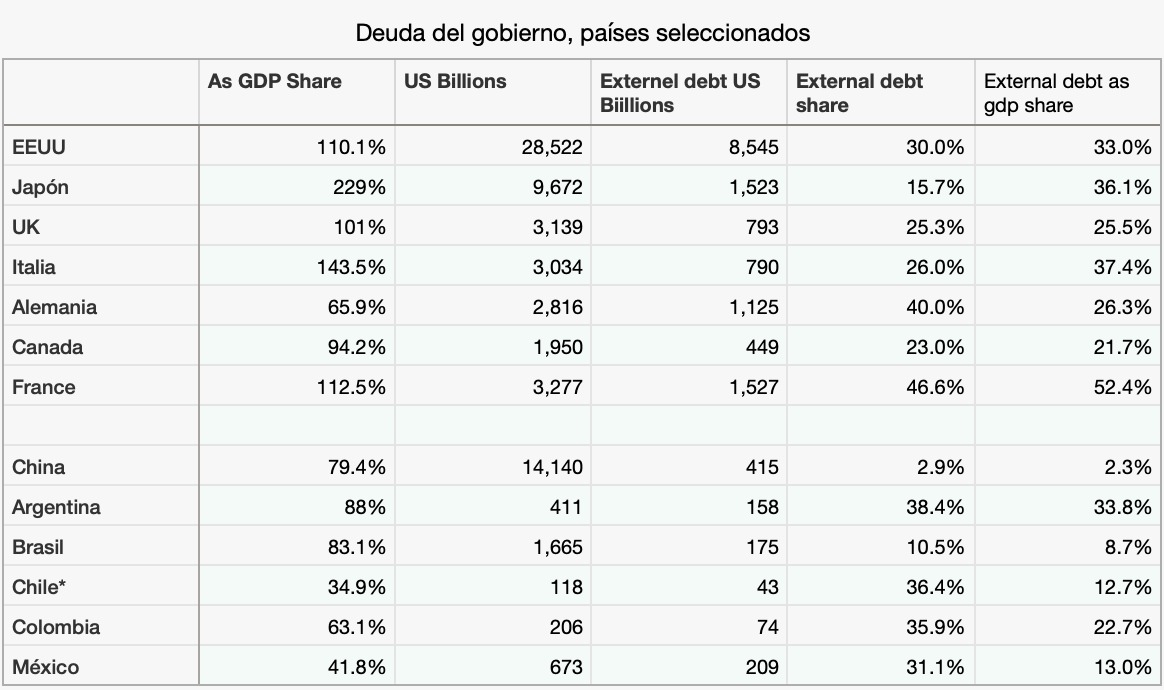

Total credit to the government sector at nominal value (core debt) in billions of dollars is much higher in advanced market economies than in emerging economies. The United States has the highest core debt, at more than $29 trillion, followed by Japan with $10 trillion. Other economies with large debts are Germany ($2.8 trillion), the United Kingdom ($3.1 billion), France ($3.2 billion) and Italy ($3 billion). These debt levels should be acceptable for the size of their economies, but the vast fiscal deficits of the G7 countries are a separate issue. Moreover, they continue to rise, thanks to rising interest rates.

The fact that developing countries hold international reserves in Treasury certificates of the G7 countries is a problem for the global system. It means that developing countries finance the advanced countries while keeping their own growth low. In addition, the instruments in which central banks hold international reserves have a negative return on investment as the interest rate is below inflation rates. This results in a subsidy from emerging nations to consumption in rich countries.

Thus, while the premise of international finance is to allow rich surplus countries to finance economic development, this is no longer the case. High debt, low growth rates, fiscal deficits and the fact that net creditors are developing countries, among others, make this impossible. The situation is similar for pension funds and savers in the prosperous G7 economies. In this framework, international finance is a brake on growth in the economies of the global south. The boom in trade in local currencies is a force that could recalibrate this situation.