COVID induced a fall in production that left the world exposed to a financial crisis derived from the lack of income of companies simultaneously as they have an accumulation of private debt and loss of profits. This text will review signs of financial fragility or instability in the region derived from private sector problems. Evidence shows that private external debt is more problematic than sovereign external debt in Latin America in the third decade of the 21st century, unlike the G7 countries.

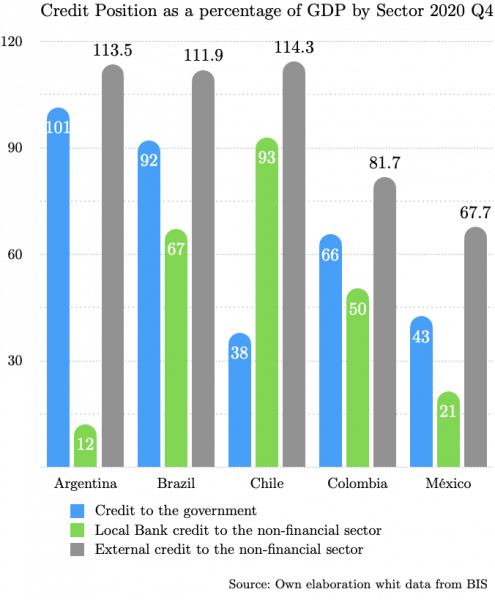

Governments took exceptional measures during 2020 to strengthen corporate liquidity in response to the Covid-19 crisis, which has resulted in increasing leverage and a significant expansion of balance sheets. Usually, the focus of international agencies has been on sovereign debt, whose ratio has risen rapidly over the past year, primarily because of falling output and slightly because of fiscal deficits [see note]. However, private debt in Latin America has been issued mostly abroad, denominated in dollars, and exceeds external public debt, issued chiefly in local currency.

In the region, Chile has the highest private-to-public debt ratio. In absolute values, the next highest in Brazil, where private external debt is almost double public debt at 111.9% of GDP. The situation is quite similar in Chile, Brazil, and Argentina and poses two problems: high interest rate risk and high exchange rate risk. Changes in the exchange rate or interest rate directly impact the cost of debt because operating expenses go up and profitability initially drops.

The problem posed is that the decrease in corporate revenues in 2020, resulting from the global closure due to COVID-19, could lead to companies experiencing losses that trigger defaults. This situation leads to increases in systemic risk and risk premium and a downgrading of international credit ratings. The European Central Bank's solution is to continue buying private debt, injecting liquidity. The Fed takes the same approach. This approach is not present in Latin America's central banks.

High levels of private external debt could lead to a costly renegotiation process to reduce or restructure it. Whether this would be done by private agents or by the state as guarantor of the country's economic activities is the question. In the hypothetical case that this was to happen, private sector debt could become a burden on the public sector.

In 2021, the problem is not a lack of foreign exchange as in 1982 but possible corporate bankruptcies. In and of themselves, the issues for Latin American governments arise from the limited fiscal space that countries in the region have and the debt servicing obligations they already have. In addition, there is the need to allocate resources to revive the economy and meet the priority needs of their populations.

These high levels of private external indebtedness represent a challenge for growth and exchange rate policy. While debt acquired in foreign currency requires the exchange rate to remain stable, not to increase the cost, the non-primary export sector requires a depreciated exchange rate. According to the mandates of each central bank, they could make different interventions in the foreign exchange market. However, the exchange rate fluctuations observed in 2020 derived from the Fed's policy of liquidity injection in March, which on the one hand depreciated the dollar and, on the other hand, appreciated Latin American currencies after March.

The post-COVID 19 economic environment looks complicated. It shows a slow recovery and low growth rates. Governments and companies need to take on more debt to solve the complex liquidity situation. Cooperation in an economic recovery policy between finance ministries and central banks with expansionary monetary and fiscal policies will be necessary to restore employment and production levels. Only in this way will the conditions exist to generate the required revenues, both fiscal, to service the public debt and private profits, to pay the interest on their internal and external credits. What remains as global private debt problems will have to find novel mechanisms to make them manageable, affecting changes in the international financial architecture.