The world is approaching a food consumption crisis. There are growing problems in the production and distribution of widespread basic foodstuffs. The slowdown in economic activities has impacted on manufacturing production linked to the world market, as well as on food processing and distribution. Prior to March 2020, there was a trend of rising food prices caused by the outbreak of African Swine Fever, which resulted in the elimination of a third of the Chinese pig herd,1 and the worst locust infestation in East Africa in 70 years.2 With production and marketing on international and local markets coming to a halt since March, when the pandemic was declared, price pressure on these commodities has increased.

The first reactions to possible shortages were hoarding. Panic buying was reported in the cities, and supermarkets restricted supply. Some countries have started to restrict food exports (Kazakhstan, Serbia, Vietnam). On the international market, this trend has rekindled tension between food exporters and their importers. According to FAO, in this context "the risk of famine is increasing in some countries, and it is even possible that several famines may occur at the same time”.3

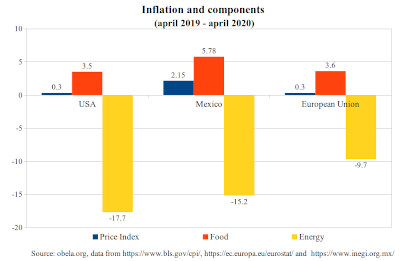

No country applied measures to curb or isolate food production. Instead, production was sought to continue at normal rates. However, what is observed in the market is not shortages due to lack of production, but to problems in the distribution channels. The supply of food, on the international side, was interrupted when the distribution channels were suspended. On the national side, the distribution channels between the countryside and the city also stopped and the supply was equally impacted. The combined effect has been a rise in food prices and basic necessities, which, however, is not reflected in the consumer price indexes, in general, due to the strong deflation of fuels and other raw materials.

The sharp drop in fuel prices is one of the clearest expressions of the effect that productive unemployment has had on the energy market. The global economic contraction, decreases consumption and international prices, while inventories increase. This condition was sought to be addressed with an international agreement to reduce production, promoted by the US with OPEC support to control the price, but it was insufficient. The almost generalized stoppages in world production activities accelerated the accumulation of crude oil and saturated inventories.

The commodity market also observes a long-term downward price trend, since 2014, accelerated in the covid19, with the Bloomberg commodity price index accumulating more than a 23% drop between January and May 2020. The impact on prices has been that the fall in the price of fuel and other commodities has served to keep consumer goods prices down. This hides in the general consumer price indexes that food prices have started to rise.

In this scenario, the economic outlook is tougher for mono-export countries, which are dependent on the world market for food. The development of means of transport, since the 1980s, created the conditions for trade and rapid transport of perishable goods from anywhere in the world. With the economic rationale of free markets, free international food trade became more profitable and the notion of food security was abandoned. We now see the consequences on prices and the risks of lack of supplies. Policies will be needed to resolve the supply situation and, above all, to address the sharp fall in household incomes and guarantee the minimum necessary consumption.

1 More: https://www.nytimes.com/2020/01/01/opinion/china-swine-fever.html

2 More: https://www.theguardian.com/world/2020/jan/26/kenya-suffers-worst-locust...

3 http://www.fao.org/news/story/en/item/1276081/icode/