A large number of businesses have stopped because of the COVID-19 pandemic, and the current economic outlook is harmful to the global economy. In terms of international trade, the trade war has weakened the world's trade flows over the past two years. The COVID-19 outbreak has further undermined this negative trend. Global production chains are fractured, as China is the leading producer in international trade, the main exporter and the second-largest importer in the world. It is also the central link in five productive branches: pharmochemistry, automotive, aeronautics, electronics and telecommunications, and in some of the leading supply chains in the world. (http://www.obela.org/en-analisis/coronavirus-a-greater-risk-to-the-world...)

This circumstance is expressed, mainly in two ways, from a financial sense and a real sense. The adverse outlook for the real sector has led to a collapse in the stock markets. To alleviate the foreseeable adverse effects, the US government approved a liquidity injection by the US Federal Reserve (Fed) even higher than that executed in the 2008-2009 crisis. They also reduced the interest rate (Federal funds rate) to minimum levels (between 0 and 0.25%), which in real terms are unfavorable, on March 15, 2020. The FED injected 700 bn dollars of Liquidity into the system through the purchase of public debt. Noteworthy are the two trillion dollars approved by the United States Senate for different ends. The US Federal Government will deliver direct payments to people without income, improve the scope of unemployment insurance; and strengthen essential medical services. Besides, the Fed has recently extended a credit line for currency swaps, to stabilize the exchange rates of its leading partners in the face of a potential fall in their currencies. These include Korea, Japan, Mexico, the United Kingdom, Switzerland, the European Union, Canada, Australia, Denmark, Sweden, and Brazil. China has also introduced a renminbi swap mechanism with its leading partners in Asia.

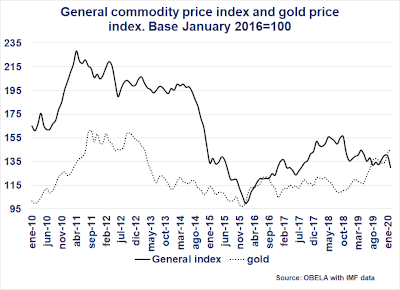

A reduction in the Fed's interest rate in the past meant a reverse effect on commodity prices in what is known as an arbitrage effect. This time, given the adverse growth prospects of the economies, lower demand for inputs is expected. Therefore future commodity prices have fallen rather than risen. However, the financial rescue seems to be changing the price trend without breaking the real demand structure of physical commodities. The pattern of significant commodity prices is downward since 2011, with a slight respite when interest rates began to fall in 2016. However, prices never recovered and are now in decline to lower levels than before.

This trend has not changed despite the drop in the interest rate to negative levels. Given the prospect of a loss of real demand for inputs, the reaction in the stock market after the announcement of the money injection has not been evident on commodity prices, which follow a downward trend. Only gold is on an upward trend. The recent decline in oil prices is noteworthy. Conflicts between Saudi Arabia, Russia, and U.S. oil and shale gas producers have resulted in lowered oil prices, putting the U.S. oil industry in difficulty.

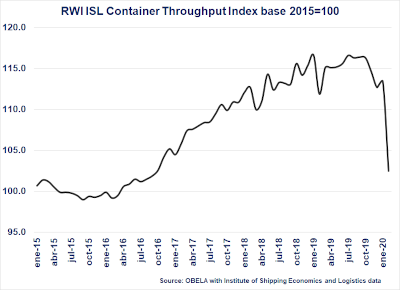

As a result of the closure of China's production and the suspension of deliveries to global value chains and as intermediate inputs, many more countries have stopped much of their output. As a result, the volume of trade is declining. The graph below shows a 15% drop so far in 2020.

International trade is suffering in both exports and imports. Lower commodity prices have a direct impact on primary export economies, such as most Latin American economies. Equally, the breakdown of production chains limits imports from much of the world. It has paralyzed Caribbean Basin countries that manufacture Chinese inputs for final goods for the U.S. market.

The world has launched economic rescue plans not seen since the 2008-2009 crisis—these range from loans to small businesses, reductions in working hours, and tax write-offs. However, the deterioration in the volume of international trade is a factor, which neither central banks nor fiscal stimuli can correct with greater liquidity, or with any other rescue program. It will not affect stimulating economic growth if there are no real-world inputs mostly made in China. The cash injected allows companies that are not operating to survive and pay their bills, but do not allow for the reactivation of production. The productive chains and inputs for markets such as the United States are stopped and the productive responses are not sufficient so far. The injection of liquidity will most likely end up in the stock exchanges as in 2008-2009.

The global economy now shows the most vulnerable part of the production chains. The complete interdependence in international trade and the lack of substitutes is evident. It also shows how limited is the capacity to respond to a reduction in material production. Taking this into account, in addition to the trade war, it seems that the globalization launched in 1990 is coming to a head