This text points out that, despite the change of government in the US, the policy and actions taken regarding Chinese technological containment remain intact, continuing to exert international pressure to prevent other countries from including Chinese companies in their digital transition processes. Still, this strategy has had little success in Latin America, where 5G technology seems a new path to economic recovery.

The expansion of 5G technology has been a turning point in the technology war between the US and China. During the Trump administration, the company Huawei, a leader in this technology, was included on the US Entity List, accusing it of collaborating with the Chinese government in computer espionage operations. Although President Biden differs on many points from his predecessor's foreign policy, the idea of counteracting China remains, proof of which is that ZTE, another critical Chinese company, has been subject to trade restrictions.

Along these lines, in June 2021, the US Senate approved a $170 billion plan to invest in research and development. It means to encourage domestic companies to manufacture semiconductors and avoid relying on Asian supply. In addition, there is $1.5 billion earmarked for 5G technology, and Cisco, Juniper Networks and Qualcomm will seek to become more competitive in the global market.

The Five Eyes allies, including the US, UK, Australia, New Zealand and Canada, have expressed concerns about Huawei's relationship with the Chinese government and rejected its entry into their territories. The refusal could delay their access to such technology by at least 2-3 years. Will any of these countries have the same reservations about implementing US-developed 5G technology, predicated on FISA-702, which allows the collection of physical or electronic data on any non-US person who poses a US national security danger?

The technology war and US fears have had a marginal impact on the Asian giant's relations with Latin America. Some countries have bowed to Washington's pressures against the use of 5G, but most continue to negotiate its implementation.

The China-CELAC forum held in February 2021 in Mexico focused on cooperation in digital technology, including 5G technology, artificial intelligence and the internet of things. It aims to assist the economic recovery of some key sectors and reverse the devastation caused by the COVID 19 pandemic.

Huawei invested close to $500m in Mexico to build a technical support centre. Chile, the most advanced country in Latin America in this area, inaugurated the first 5G zone in the region, and Brazil announced this year it would hold the first tender for contracts to install it. All indications are that by 2022 all cities and the district of Brasilia will have 5G technology, and like Chile, Huawei will not be out of the auctions.

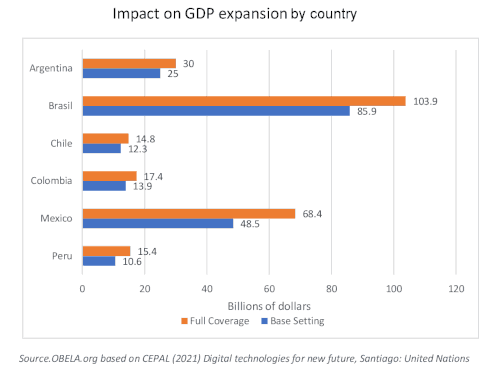

The region's challenges to put this technology into operation relate to the lack of infrastructure and the size of the investment. According to ECLAC, Argentina, Brazil, Chile, Colombia, Mexico and Peru would need to invest USD 50.8 billion to enable 5G technology in their urban areas and around USD 120.07 billion to cover their entire territory. It is worth noting that full coverage of 4G network territories is still incomplete and that a few countries have the spectrum released in the 3.5 GHz range for the proper operation of the network. The same report states that the region's technological transition could increase Latin American GDP between $229 billion and $293 billion by 2030.

Latin America's neutral stance on the technology war between the two powers does not mean that the US will stop exerting pressure in various areas to avoid losing the technology race in the region. US Ambassador to Brazil Todd Chapman said in an interview that there would surely be consequences if the country decides to include Huawei in its technology development plans, as the US will think twice before investing in Brazil. For Brazil, the US is no longer a significant investor nor a critical trading partner. The withdrawal of the US in this context will only benefit China's presence.

The Asian giant is one of Latin America's most important trading partners, and the benefits of adopting 5G technology are innumerably greater than the benefits of sidelining Chinese companies. The US will have to look for a giant stick or carrot.