The energy transition in Latin America has the structural problem dragging on in the region forever: the lack of capital. External financing has been the main driver of change in the energy matrix. Where does the financing come from, and what does it mean?

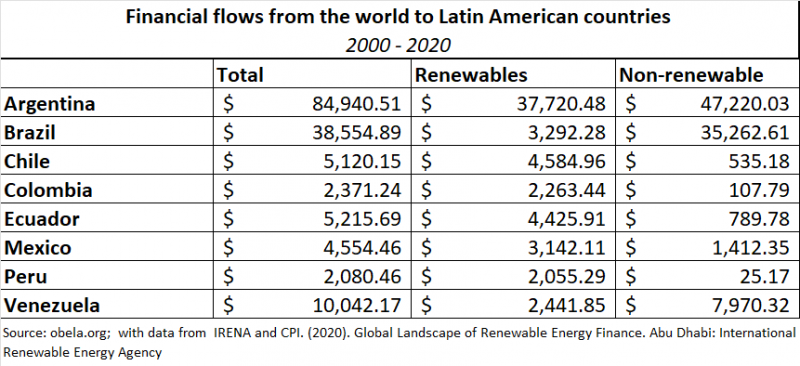

From 2000 to 2020, 26% of global financing for energy projects went to Latin America. In the period, $84 billion came in through debt, equity purchases and subsidies. Of this, 44% went to renewable energy projects. The general trend is an increase in financing for renewable projects. The main financiers are the Export-Import Bank of China, the China Development Bank, the Inter-American Development Bank (IDB), the Development Bank of Latin America (CAF) and the US Agency for International Development, in that order.

The main destinations for non-renewable energy are Brazil and Venezuela, mainly oil extraction projects financed by Chinese development banks. For renewable projects, they are Ecuador, Chile, Argentina and Mexico. The leading financier for Ecuador is China, with $4 billion. The bulk of the amount loans to Rafael Correa's administration to construct hydroelectric plants in the country. With Chinese technology, Ecuador achieved 76% of the country's electricity generation from hydropower by 2018. The next largest financier is the IDB, which lent Ecuador $120 million to construct solar parks in 2016.

Contrary to the behaviour in South America, Chile's leading financier in the US, with a total of approximately USD 1 billion for the 2000 - 2020 period. However, in 2013 and 2014, there were substantial investments by US companies in solar parks. Since then, there has been no further activity. The most noteworthy are the US solar energy company SunEdison Inc. loans to the Chilean companies Amanecer Solar and San Andrés for 326 MDD for the construction of solar parks in the Atacama Desert. The second-largest financier is China, with a similar amount of USD 943 million for solar parks in 2012. It places Chile as a territory of the dispute between these two powers.

In Argentina, China is the leading financier with $3 billion in the period studied. The best-known project financed by the Asian economy is the Cauchari solar park in Jujuy with Chinese design and technology. The government of Jujuy issued green bonds for $339 million that the Export-Import Bank of China bought. The second-largest financier is the IDB and the third-largest in the US Department of Energy.

In Mexico, the main financiers are France, Germany and the US, which have around 600 MDD in the period studied. The French Development Agency lent, in 2019, 60 MDD for the construction of two wind farms and four solar farms by the French company Engie throughout the country, and, in 2020, 110 MDD to the Federal Electricity Commission (CFE) for the development and research of geothermal energy. In 2021, Électricité de France reported 200 million euros with the CEF over 25 years to rehabilitate 14 hydroelectric plants; this is 14 million euros per hydroelectric dam. The State Development Bank of the Federal Republic of Germany financed promotion and scientific cooperation programmes for renewables from 2016 to 2018. The Agency for International Development and the US Department of Energy-funded energy projects of all types actively from 2000 to 2015 in Mexico. Since then, the only record is a loan from Sempra Energy for the construction of four solar farms in 2020.

It is noteworthy that South America and we mainly finance the Caribbean Basin by China. Although the US finances renewables more than dirty energy, in terms of amounts, it does not compare with the Asian economy. From 2000 to 2020, China has financed renewable energy projects for more than $9.5 billion and the US just $3.4 billion. A possible entry point for the Asian giant into the Caribbean region could be Cuba. There are investments and loans for energy, infrastructure and the purchase of electric cars.

China's presence in the region responds to the New Silk Road megaproject. US investments and, with Mauricio Claver-Carone at the helm, the IDB act as obstacles to the Asian giant's expansion in the Caribbean Basin, in particular, and Latin America in general. The Biden administration even proposed the global Build Back Better World project as a counterweight to stop China's expansion in Latin America.

External financing for renewables is vital for Latin America's energy transition. Without foreign capital, it is difficult for the change to be steady and orderly. Financing will continue to increase from the G7. However, it seems that China does not intend to let them take the lead, so the West must increase the size of investment in order not to lose the geo-economic race. Latin America is a disputed territory for the major powers, and control of renewables is vital.