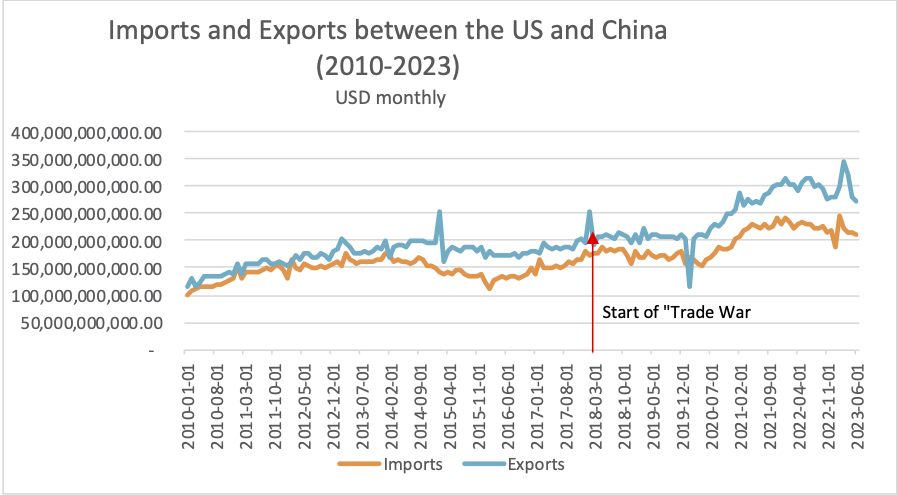

Since 2018, the United States has begun to hinder China's trade relations with the world, resulting in a slow but noticeable decline in trade with the Asian giant. The impacts of this "war" are especially evident in the disruption of supply chains, given that most technology products have some link to China, which has caused a marked decline in global economic activity. But what are the implications for the global economy?

It is essential to underline the importance of this blockade for the world economy. China is currently the leading exporter of technological products but is the first link in the automotive, aeronautics, telecommunications, renewable energy and pharmochemical industries. These exports have declined recently, especially to the United States and its allies. It leaves the West needing more supplies.

Because of the conflicting nature of this situation, the data can be contradictory, as much of the world's economic stability depends on a dynamic US and China that is primarily engaged in providing the rest of the world with technology and innovation. However, although the numbers are lower than expected, they are positive. China has been gradually transforming into more than just the "factory of the world". It has become an autonomous powerhouse. Technology is the leading supplier of most goods on the world market and has acquired raw material markets abroad, thus consolidating its position as the "Asian Giant" we all know.

The trade war has created net trade opportunities rather than simply shifting trade destinations. It has allowed "peripheral" nations to strengthen their relations with the current central economy. It has created opportunities for China to engage with countries with which the US has little trade. The so-called "bystander" effect has provided more significant opportunities for countries such as Mexico to increase their exports to the US.

Meanwhile, with the help of the BRICS, China is exploring new directions by overseeing a series of Silk Belt projects that include agricultural growth in Brazil and financing the construction of a new port in Peru, among other things, to consolidate its position globally.

Inflation in the US has a year-on-year increase of 4.9%, according to the Bureau of Labor Statistics as of 2023. The IMF, for its part, forecasts a 2% increase in consumer price inflation in China by the end of the year, which does not seem to be so sure, as she has entered a period of meagre inflation in August and may end the year at 1.5% or less.

Remembering the Chinese government's control over the economy and scope is crucial. They can take measures to regulate their business cycle if necessary. However, some factors may contribute to the fact that, even with their intervention, they cannot avoid issues such as overcapacity, the effect of falling international demand and the behaviour of global prices. These are more visible in the midst of the trade war.

The most recent periods have only demonstrated how assertive China is to the rest of the world, despite distortions (Chinese recession and deflation) in the Western press and growing US concerns about its own economic fragility (slow growth, high inflation) and technological backwardness. The latter has led to that country's policies of protection and de-globalisation.

In short, the world splits on two fronts: on the one hand, the de-globalising US is facing slow growth, blaming China for its external problems and deficits. On the other hand, China and its growing domestic market are open to globalisation, facing the real challenges generated by the trade war. The trade war has a more significant negative impact on the US than on China, as it has blocked trade with the world's leading supplier of technology goods and leader in the renewable energy sector, among other industries. China has gone from being a rising economy to virtually a new superpower, and the days of US dominance in innovation, new industrial branches and global economic regulation are gone, eroding the confidence of many nations.

In short, the world splits on two fronts: on the one hand, the de-globalising US is facing slow growth, blaming China for its external problems and deficits. On the other hand, China and its growing domestic market are open to globalisation, facing the real challenges generated by the trade war. The trade war has a more significant negative impact on the US than on China, as it has blocked trade with the world's leading supplier of technology goods and leader in the renewable energy sector, among other industries. China has gone from being a rising economy to virtually a new superpower, and the days of US dominance in innovation, new industrial branches and global economic regulation are gone, eroding the confidence of many nations.

Eventually, an initial economic conflict became a glaring example of geopolitical resentment and fear of change on the part of prominent economic actors. It results in global economic and political consequences, such as disruptions in global supply chains and the mutual imposition of tariffs and trade restrictions. It complicates production for many industries dependent on Chinese inputs, contributing to fear and distrust in a globally slowing economic situation.